Celent invited innovation professionals from insurance firms to provide their outlook for 2018 in an online survey. The participants are all innovation practitioners who bring a current and practical perspective to their predictions. Their feedback is valuable for leaders who want to benchmark and advance the innovation capabilities in their firms.

With the onset of a new year, Celent clients want to understand the innovation outlook for 2018. To gain some insights, Celent conducted an online survey and invited innovation professionals from insurance to give their predictions for the upcoming year. What is expected regarding consumer expectations and industry disruption? In which areas will investment increase or decrease? Will making progress with innovation be easier or harder?

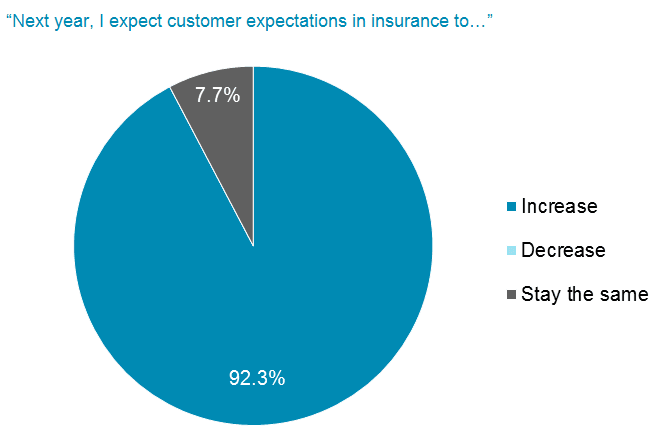

Innovation continued to gain traction in 2017. Customer expectations, the imperative of digital transformation, regulatory scrutiny, growth needs in the face of increasing competition, and expense pressures provide impetus for change.

Additionally, emerging technology and insurtech provide opportunities. Sensors and intelligent digital ecosystems blur the boundaries between the digital and physical worlds and generate massive new data sources. Next-generation analytics and artificial intelligence are coming on stream to harness that data and provide new services to prospects and clients.

In response, Celent expects the need for effective innovation in insurance to continue to accelerate. With the onset of a new year, Celent surveyed innovation practitioners to understand their outlook for 2018.