The 2020 edition of Oliver Wyman's annual report with Morgan Stanley offers an overview of industry trends and analysis in wholesale banking.The COVID-19 pandemic and its economic repercussions are putting wholesale banks‘ resilience to the test. This year’s report sketches out three alternative scenarios for the evolution of the pandemic and its economic impacts, ranging from a rapid rebound to a deep global recession, and assesses the implications for wholesale banks over the medium term.

The impact on bank earnings

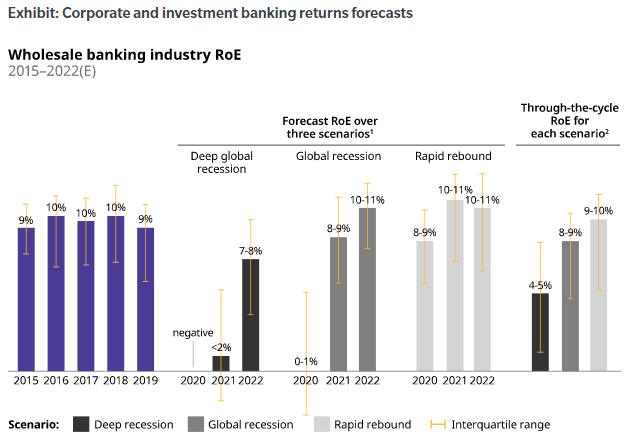

The combination of lower revenues and elevated credit losses could drive earnings down by 100 percent in our central case to over 250 percent in our deep global recession scenario. Compared to previous cycles, OW projects over 10 quarters worth of earnings lost in our deep global recession scenario, compared to 14 during the global financial crisis, and 4 to 7 in prior shocks.The industry has built extensive capital and liquidity buffers to withstand this kind of stress event, putting them in a position to play an important role as shock absorber for the economy. But profitability going into a crisis has never been lower, and the pressure on earnings could reveal structural weaknesses in the business models for some banks. OW's analysis suggests that, through the cycle, some banks will deliver returns of less than 5 percent, well below the 10 percent targeted by investors. OW explores the drivers of resilience across wholesale banks and the role of scale in driving profitability when costs are increasingly inflexible.

How the structure of the industry may change

Technology providers for the wholesale banking industry have been growing rapidly and attracting high valuations, and we do not think the pandemic changes this value story. We estimate the industry has created $50 billion in equity over the last 5 to 10 years, and could generate another $60 to 120 billion in the next 3 to 5 years. We discuss how wholesale banks should respond as part of their efforts to restructure their cost base, and participate in the equity upside.