Celent recognizes Zions Bancorporation as the 2018 Model Bank for Core Banking Transformation.

Zions Bancorporation successfully implemented the first of three phases of a multiyear core transformation program, partnering with an international vendor for an extensive migration across the entire bank.

The size of the US banking market and the relative age of the most common core platforms present a lucrative market opportunity for outsiders. However, to date, the US core market has been dominated by a few large domestic vendors.

With significant barriers to entry and few migrations annually, international core vendors have struggled to gain a foothold despite multiyear efforts and strong product offerings. The lack of adoption of modern core platforms (particularly from international vendors) has been a factor in keeping US institutions insulated from many of the technologies now standard in other regions globally (e.g., real time or componentized architectures). As banks begin broad transformation initiatives, however, they are beginning to look to a broader range of platform partners for more meaningful modernization in a market historically impervious to change.

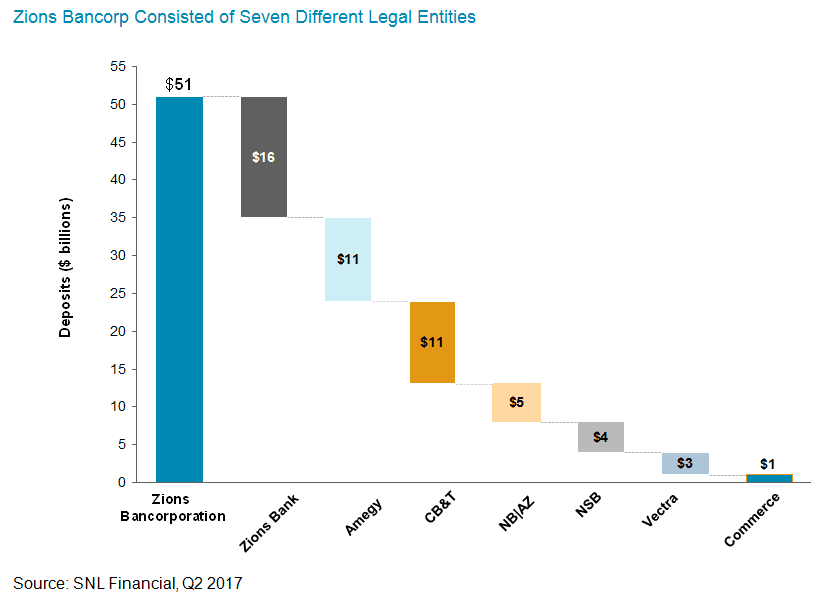

In 2013, Zions Bancorp issued an RFP to eight separate vendors for a new core. It needed to take a fragmented system of six operating environments and migrate to an integrated and modern core solution. The bank wanted something different, a modern core platform, and it quickly short-listed a few international vendors. The bank ultimately decided on TCS BaNCS, making it one of the largest US banks to migrate to a core system from an international vendor.