After the Purchase Order: Easing Pain Points in B2B Transactions

Abstract

Credit is tight and business to business transactions still feature slow, manual, inefficient processes. Celent identifies buyers' pain points, technological solutions, and solution providers for the evolving business climate.

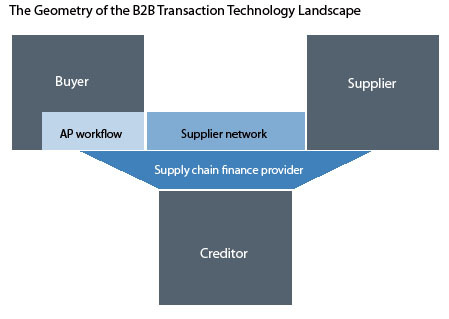

As corporations search for new ways to reduce costs, there is a fair amount of re-examination in how buyers handle their largely manual, paper-intensive business to business transactions processes. Celent argues in After the Purchase Order: Easing Pain Points in B2B Transactions, that the worst pain is in manual accounts payable processes, paper-based communications with suppliers, and poor control over the financial supply chain. And vendors of products that ease these pain points are poised for 25-50% annual growth rates.

Buyers’ goals are deceptively simple: move away from paper, reduce headcount, and get into a position to deliver cash to a supplier earlier but, to date, no one solution has proved robust enough to emerge as a clear winner. Accounts payable automation solution providers (Ariba, Bottomline, 170 Systems) create one piece of the solution by speeding a buyer’s internal processing. Networks (Ariba, OB10) form another as a 21st century postal service for transactional documents. And independent supply chain finance providers (Orbian, PrimeRevenue) serve as the third by providing suppliers access to timely, inexpensive credit.

"This new approach to the B2B transaction technology space should allow readers to more clearly see the increasing maturity of adjacent segments and their opportunities for further growth," says Justin Zalkin, an Oliver Wyman consultant who co-authored the paper.

The first section of this report looks at the pain points and challenges in B2B transactions and some of the different approaches taken by vendors. The second section of the report analyzes each of the providers based on their strategy and approach to the market, the evolution of some of their solutions and how they came to settle on solving a particular B2B problem. It also includes an overview of the basic functionality of a vendor’s offering. The third section looks at the developing partnerships in across the B2B landscape and what that portends for the future. The fourth section examines the strengths and challenges of each group of vendors.

The report is intended for technology providers, banks that offer corporate transaction services or trade finance, and corporate CFOs.

The 82 page paper contains 22 figures and 16 tables. Profiles include accounts payable automation providers (Ariba, Bottomline, and 170 Systems), networks (Ariba and OB10), and independent supply chain finance automatiors (Orbian and PrimeRevenue).