A Product Does Not a Patent Make

5 April 2010

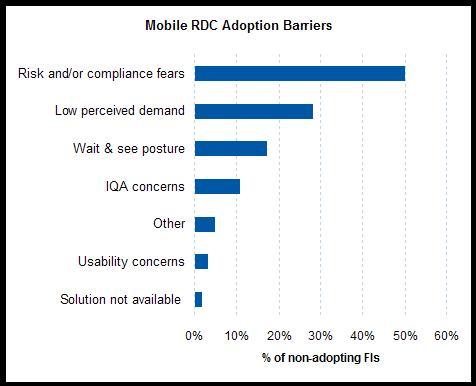

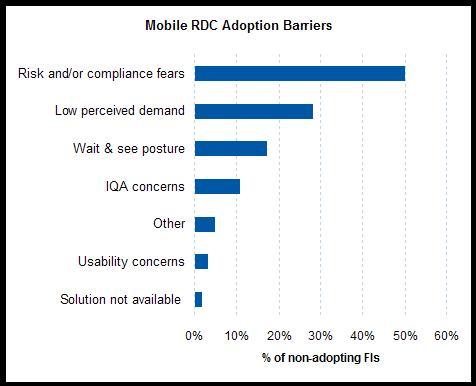

In November, 2009, the Electronic Payment Order, or fully-digital check was popularized in a paper published by the Chicago Fed. In the paper, the authors agued that since paper checks are now routinely cleared by fully electronic means, why not originate the instrument electronically as well. The idea may be sound. After all, the only meaningful negative associated with check payments has been the costs and delay associated with handling paper. Now, there may be an opportunity to eliminate paper entirely, while retaining the benefits of the check as a payment mechanism and leveraging the recently modernized US check payment system. Global Standard Financial (GSF), an Alpharetta, GA based start-up holds several patents on the idea. Unlike Data Treasury, however, GSF appears intent on actually bringing products to market and generating revenue through their licensing. It sounds simple: create check images, send them to the payee electronically, and let the payee deposit them as an image cash letter along with other scanned checks and EPOs. But, financial institutions must be willing to embrace EPOs for all this to occur. Something tells me that risk managers may be hard to win over. Remote deposit capture (RDC) may be illustrative of what lies ahead with EPO adoption. After five years of growth as a commercial product, over one million capture points and adoption by over two-thirds of all US financial institutions, RDC has largely failed to migrate to the consumer realm. And it’s not for lack of product. All the leading solution providers offer off-the-shelf solutions that support TWAIN compliant scanners and many now also offer solutions for mobile RDC – using smart phones to do the image capture. With such an apparently strong concept and readily available technology, why aren’t banks offering RDC down market? One reason: compliance risk. Last fall, Celent surveyed 174 US financial institutions to better understand RDC adoption dynamics. In part, we asked FIs that had no plans to implement consumer and/or mobile RDC products why not. Compliance risk was the #1 adoption barrier. [caption id="attachment_1317" align="aligncenter" width="476" caption="Compliance Risk is Limiting RDC Deployments"] [/caption] So even after patent-pending solutions for EPOs hit the market (should that occur), it may be some time before banks get comfortable with the idea. Failing that, payment system innovation may require non-banks to take the lead. More on that in a later blog.

[/caption] So even after patent-pending solutions for EPOs hit the market (should that occur), it may be some time before banks get comfortable with the idea. Failing that, payment system innovation may require non-banks to take the lead. More on that in a later blog.

[/caption] So even after patent-pending solutions for EPOs hit the market (should that occur), it may be some time before banks get comfortable with the idea. Failing that, payment system innovation may require non-banks to take the lead. More on that in a later blog.

[/caption] So even after patent-pending solutions for EPOs hit the market (should that occur), it may be some time before banks get comfortable with the idea. Failing that, payment system innovation may require non-banks to take the lead. More on that in a later blog.Comments

-

I'd love to learn more about the compliance risks and concerns around mobile RDC...any pointers?

DataTreasury vs. US Bank:

http://www.businessweek.com/news/2010-03-27/u-s-bancorp-told-by-jury-to-pay-27-million-to-datatreasury.html

Get your facts straight! DataTreasury attempted to form joint ventures with several large banks however the banks chose to steal their property instead. A jury recently found in favor of DT vs. US Bank.