Increasing investments are being made in insurer-startup partnerships. But what makes such a collaboration a success? A survey of 89 insurers and 78 technology startups offers insights into maximizing value.

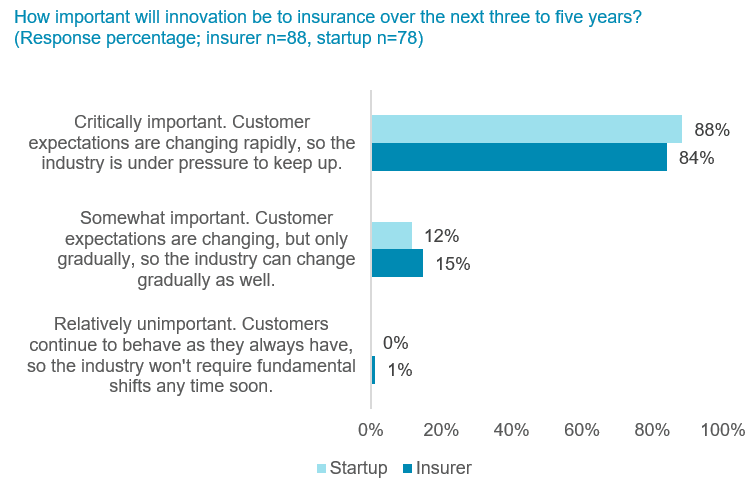

There is significant alignment between insurers and startups regarding the need for innovation in insurance. Over 80% state that innovation in insurance is critical to meet customer expectations over the next three to five years. But what makes these arrangements work? Celent has researched best practices in partnership arrangements since 2016. Two online surveys generated responses from 89 insurers and 78 insurance-focused startups. This study presents these findings and identifies best practice.