The move against the high frequency traders is well and truly on. The interdealer market has seen a paradigm shift as the sell-side banks with their manual trading practice have been practically crowded out of the market by the high frequency traders. High frequency trading, in this context, is defined as the subset of algorithmic trading where a large number of small-in-size orders are sent to the market at high speed, with round trip execution times, usually measured in milliseconds (Brogaard, 2010).  With the HFT firms actively participating in the FX market, it had become difficult for the manual trading segment to compete effectively. The HFT liquidity detection strategies and “quote and cancel” techniques have been driving the banks to improve their technology infrastructure and algorithmic trading strategies. This is affecting the Ai market, which is the artificial intelligence clientele of EBS. Since this is causing concern to the banks which indulge in manual trading, EBS has modified the trading rules for its clients.The rules are expected to bring manual traders to build a level playing field for the banks. Also, this will help EBS regain the number 1 position in terms of volume share, which has been affected for the last 6 months. Another key issue in this market is that banks already forming own consortia to enable their manual traders which will remove volumes from the top interdealer brokers including EBS.

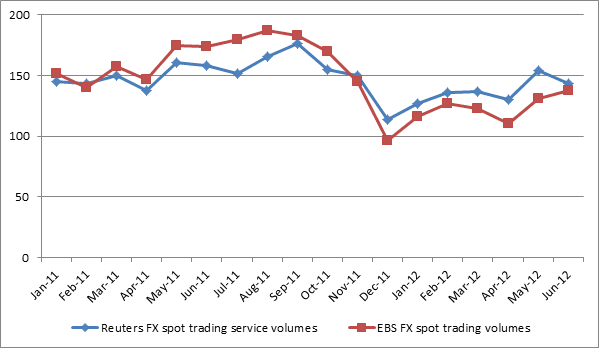

With the HFT firms actively participating in the FX market, it had become difficult for the manual trading segment to compete effectively. The HFT liquidity detection strategies and “quote and cancel” techniques have been driving the banks to improve their technology infrastructure and algorithmic trading strategies. This is affecting the Ai market, which is the artificial intelligence clientele of EBS. Since this is causing concern to the banks which indulge in manual trading, EBS has modified the trading rules for its clients.The rules are expected to bring manual traders to build a level playing field for the banks. Also, this will help EBS regain the number 1 position in terms of volume share, which has been affected for the last 6 months. Another key issue in this market is that banks already forming own consortia to enable their manual traders which will remove volumes from the top interdealer brokers including EBS.