Actual vs. Perceived Value (Behavioral Economics)

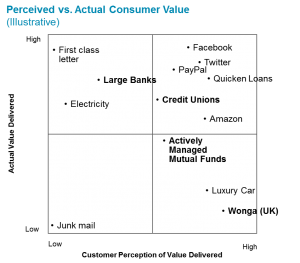

Banks have a problem: they deliver a great deal of value (safe storage of money, ability to transfer funds, source of credit, etc.), and yet customers typically think that most of these functions should be free (on the deposit side) or should cost less than they do (lending). To be fair, many banks have moved away from free checking, but there’s enough advertising out there around free checking that consumers resent having to pay a fee to store and access their money. In other words, banks deliver a lot more value than they’re getting credit for. Credit Unions, on the other hand, have a different relationship with their members, who value that relationship more highly. We can argue about the actual value CUs deliver relative to banks (lower fees and rates didn’t quite make up for large banks’ breadth of services in my calculations), but it’s clear that CU members feel they’re getting a better deal than bank customers. An organization's goal, of course, is to deliver high value and be recognized for it. I’d argue that many free internet services fall in that bucket; the examples in the upper right quadrant above are just a few. Potentially even better is to be perceived as delivering even more value than you actually do. I’d put luxury cars in that category, obviously, but would also put actively managed mutual funds there: the majority (after fees) fail to beat their benchmark over time, yet consumers still feel that they’re getting diversification, performance, and expert guidance. Wonga, a UK short-term lender, offers instant (ok, within minutes) credit, but at very high rates. Their cute commercials help soften the blow and make consumers feel better about paying such high rates, although for credit they likely couldn’t get elsewhere, and certainly not as quickly. The low/low bucket is for things like junk mail – little value, and we feel it. And yet, there’s enough value for the sender that it keeps coming. The worst quadrant for a provider is the upper left – it’s where products and services are taken for granted. Electricity is pretty close to a miracle, and the price we pay is miniscule. Yet no one sings it praises. And despite being the butt of jokes, the US Postal Service will deliver a letter from Miami to Anchorage for 49 cents; that’s, objectively, pretty phenomenal. But, we feel like…that’s just the way things should be. And it’s the same for banking services. How do banks get out of this? Of the two levers, actual and perceived value, lowering the actual value is not an option given today’s competitive landscape, so banks have to increase the perceived value. Part of that lies in improving the actual, of course (through better products and services), but a more significant part lies in engaging customers in a visceral way and in materially changing the relationship that banks have with them. Each bank is going to have to chart its own course, but improving customer perception on a very basic level is critical for future success.

Banks have a problem: they deliver a great deal of value (safe storage of money, ability to transfer funds, source of credit, etc.), and yet customers typically think that most of these functions should be free (on the deposit side) or should cost less than they do (lending). To be fair, many banks have moved away from free checking, but there’s enough advertising out there around free checking that consumers resent having to pay a fee to store and access their money. In other words, banks deliver a lot more value than they’re getting credit for. Credit Unions, on the other hand, have a different relationship with their members, who value that relationship more highly. We can argue about the actual value CUs deliver relative to banks (lower fees and rates didn’t quite make up for large banks’ breadth of services in my calculations), but it’s clear that CU members feel they’re getting a better deal than bank customers. An organization's goal, of course, is to deliver high value and be recognized for it. I’d argue that many free internet services fall in that bucket; the examples in the upper right quadrant above are just a few. Potentially even better is to be perceived as delivering even more value than you actually do. I’d put luxury cars in that category, obviously, but would also put actively managed mutual funds there: the majority (after fees) fail to beat their benchmark over time, yet consumers still feel that they’re getting diversification, performance, and expert guidance. Wonga, a UK short-term lender, offers instant (ok, within minutes) credit, but at very high rates. Their cute commercials help soften the blow and make consumers feel better about paying such high rates, although for credit they likely couldn’t get elsewhere, and certainly not as quickly. The low/low bucket is for things like junk mail – little value, and we feel it. And yet, there’s enough value for the sender that it keeps coming. The worst quadrant for a provider is the upper left – it’s where products and services are taken for granted. Electricity is pretty close to a miracle, and the price we pay is miniscule. Yet no one sings it praises. And despite being the butt of jokes, the US Postal Service will deliver a letter from Miami to Anchorage for 49 cents; that’s, objectively, pretty phenomenal. But, we feel like…that’s just the way things should be. And it’s the same for banking services. How do banks get out of this? Of the two levers, actual and perceived value, lowering the actual value is not an option given today’s competitive landscape, so banks have to increase the perceived value. Part of that lies in improving the actual, of course (through better products and services), but a more significant part lies in engaging customers in a visceral way and in materially changing the relationship that banks have with them. Each bank is going to have to chart its own course, but improving customer perception on a very basic level is critical for future success.Comments

-

[…] Actual vs. Perceived Value (Behavioral Economics) […]

-

Steve,

Taken as a whole, the credit union universe offers services comparable to banks. So while there may be a few leading-edge CUs who offer the latest features, individual CUs tend to lag when offering new technology (e.g., Mobile Remote Deposit Capture). -

Hi Dan, great post! You make a key point regarding the bank's need to materially change the relationship with their customers. Bank's offer a wide range of services but the real value lies with the role the bank plays in facilitating their customer's daily lives. This is powerful and we (us bankers) need to view our services from that point of view. The more meaningful and relevant relationships we build the farther "right" we will move on your graph.

-

Dan, Interesting topic , largely ignored/taken for granted aspect well articulated and presented. Getting the customer to realize the value actually delivered by the institution and a possible measure to gauge what customer truly perceive valuable of the service or product offered by the institution would be the focus. Understanding the customer and having a customer centric approach will be the key.

-

Thanks, Tom. The meaning that you mention is key; otherwise banking services are just commodities.

-

Thanks, Sathish. I'd add to your point that factoring in the emotional component will also be important.

What kinds of services do large banks offer that credit unions don't?