Capital Markets 2020 Research Outlook

Abstract

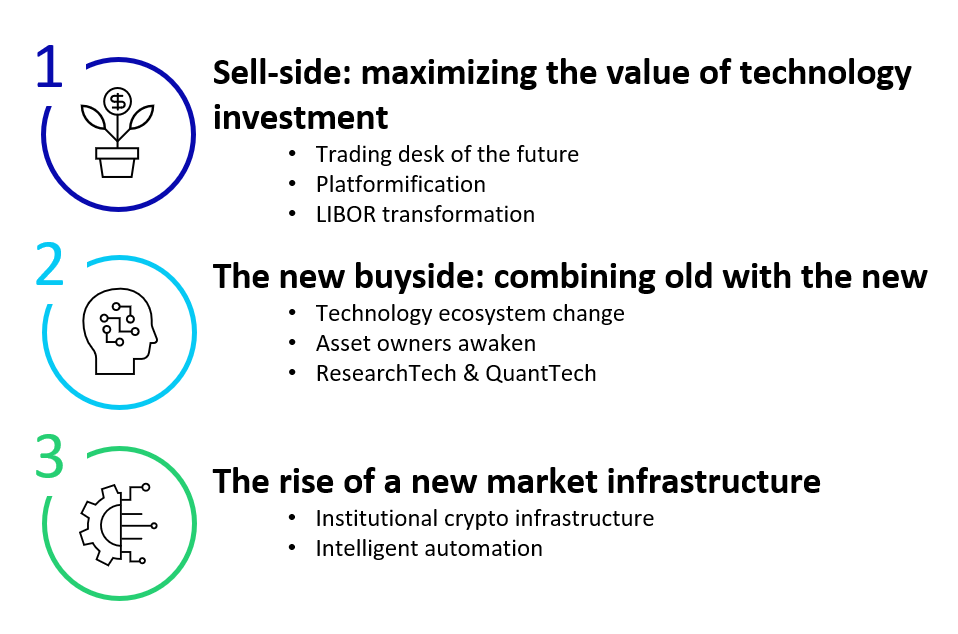

TOP TRENDS DRIVING CHANGE IN CAPITAL MARKETS

Sell side: maximizing the value of technology investment

Treasury and capital markets divisions of banks continue to struggle with the trilemma of complying with regulations, meeting evolving client demands, and improving economics. Amidst cost pressures, the desire for balance sheet efficiency, and the continued rise of non-bank competition (trading, hedging, and other areas that are up for grabs), banks must move swiftly to embrace technology and become leaner. As a result, the sell side is trying to maximize the value of its trading technology investments by desiloing, making strategic technology choices (including partnerships and platforms), and creating internal processes that tie the business closer to technology. Doing so while not being distracted by major disruptions (e.g. LIBOR) is a major challenge for 2020.

Trading desk of the future — Intelligent desiloization

Intelligent desiloization (quite a mouthful!) is one strategy and involves optimizing the balance sheet and improving the cost structure through automation. Banks are expanding trading technology across asset classes, improving portfolio trading tools, and tapping into emerging data and analytic models in the cloud. They seek the expansion of client interaction through APIs. In addition, innovation and technology adoption is being driven into primary trading technology and risk/pricing models for more bespoke investment structures.

Technology Innovation in Capital Markets

For banks and brokerages, external vendor engagement will accelerate in 2020. Banks are increasingly turning to fintech providers to drive technology innovation, but the ability to easily access and integrate new solutions is often constrained by complex and inflexible internal technology. Growing adoption of cloud and open APIs are creating new avenues for smoother interaction in the technology ecosystem and giving rise to platform-based models.

Special Focus: LIBOR

London Interbank Offered Rate (LIBOR) is expected to be diminished and retired after 2021 and market participants are beginning to craft concrete foundational steps to transition from LIBOR to transaction-based alternative reference rates. This change will not only transform the landscape of available products but given LIBOR’s ubiquity in the plumbing of financial systems, its departure will have an extraordinary impact on front office, risk, and treasury processes, and affect both technology and operations.

The new buyside — combining old with new

Buyside technology ecosystem change

Secular themes are currently playing out throughout the investment sector around alpha generation, cost reduction, and the ongoing digitization of the investment value chain. Apart from near-term trends (such as regulation, pricing, and fee pressures), investment management incumbents expect technology adoption and digitization to be disruptive in the long run.

Investment industry executives have been awakened to the possible disruptions from the rapid adoption of new technologies and digitization effects in shaping investor buying behaviours, investment management capabilities, operational improvements, and the rise of new competitive propositions, enabled by next generation technologies (including the threat of Big Tech firms from outside the financial industry entering the investment management sector). Throughout 2002, we will present insights on the shape of the service provider landscape, change scenarios and end-states, and important implications for buyside firms.

Asset owners: Slumbering giants awaken to the promise of technology

Under a backdrop of a drawn out, low interest rate environment, asset owners continue to shift portfolio flows into complex assets and investment vehicles (alternatives assets, private equity, hedge funds, & derivatives), as well as more sophisticated investment approaches. Investment regulations and stakeholder expectations continue to grow – driving the search to achieve better investment outcomes and manage mandates across external investment partners.

From an operational perspective, pension entities, sovereign wealth funds, endowments, and foundations are looking to embrace the potential of next generation digital technologies to change the way they deliver investment operations and engage stakeholders.

Portfolio Construction, ResearchTech and QuantTech

The buyside is demanding better decisioning around pre-portfolio construction in more asset classes. They seek new data services (data as a service, analytics, content) in an increasingly cloud-based environment. On the execution side, they seek deeper counterparty, broker, and venue intelligence for better trading analytics. Research analysts (both fundamental and quantitative) are leveraging advanced analytics, data workbenches, and NLP/NLU. They need integrated data sets to test/backtest strategies, program and implement algorithms, and conduct portfolio construction and periodic optimization.

QuantTech platforms are centralised data science environments with enterprise grade data and quantitative analytics for development, testing, and production tasks. They are essentially industrialized, factory like data and model building facilities that allow quants, experts, and end users to consolidate, prepare, and manufacture analytical and data components. They also act as platforms to distribute and interface to a supply chain of connected applications or users, which need access to the data and analytics within these environments.

Ongoing risk, accounting & capital requirements, such as for loss forecasting (CECL, IFRS 9), stress testing (CCAR, ECB) & enhanced market risk capital framework/ FRTB require integration of many risk and finance data elements across a broad range of business functions – a major challenge for most financial institutions today.

Regulatory Reporting Challenges and Responses

For investment firms and providers at the forefront of addressing regulatory obligations, our research will analyse the industry's future trajectory, operations/IT dynamics and solution ecosystems which hold the potential to break in and create opportunities to drive step changes and improve bottom line efficiencies.

The rise of a new market infrastructure - emerging technologies

Institutional crypto — infrastructure for crypto assets

We will continue to highlight the key themes, players, and areas to watch out for as 2020 is shaping up to be the year that bitcoinization of the global capital markets begins in earnest. Bitcoin's journey to institutional and regulatory acceptance is almost complete as Bakkt and other platforms go-live with regulated on-ramps for institutional capital. Derivatives promise to be a very significant, liquid, and profitable arena of cryptocurrencies. Crypto derivatives promise to be the largest and most innovative area of this new asset class.

One area we will focus on in 2020 is the need for institutional grade infrastructure to support issuance, trading (SOR), connectivity and custody. Institutional-grade technology has arrived as we move into the era of regulatory and institutional legitimacy for this new asset class. However, the market structure for digital assets is likely to look different to that of traditional markets as market infrastructures integrate with open-architecture of public blockchains.

Platformification will be a key theme in 2020 as APIs and cloud infrastructure create new opportunities to drive innovation. We assess the role of open-source protocols and public blockchain ecosystems in this quest for innovation and focus on where the value will be captured in these emergent technology ecosystems.

Finally, significant capital, new ventures, and partnerships have emerged in the securities tokens space. Extensive dialogue has occurred between asset managers, asset owners, regulators, and vendors regarding tokenizing assets.

Surveillance - Improving effectiveness with automation & analytics

Artificial intelligence and machine learning empowered solutions are making rapid inroads into capital markets surveillance operations as firms seek better analytics and automated workflows to improve efficiency and effectiveness.

Intelligent automation— Renewing the middle and back office

Digitalization and growing volumes are driving the need for more automation and straight through processing in trading and will require improving reconciliation match rates and exception handling capabilities. In 2020, we will discuss how new technology such as cloud and intelligent automation are driving the evolution of reconciliation solutions and profiles vendor solutions from incumbents and industry newcomers.

2020 RESEARCH THEMES

Four areas will permeate our capital markets research. While our space changes quickly enough that we’ll respond to fast moving new developments, analysts will be focusing on cloud, AI/machine learning, data and, of course, our flagship Model Asset Manager Awards (to be published in April).

Cloud

Cloud implementations are becoming increasingly common and are becoming a key feature of infrastructure across global capital markets. With experience, banks and asset managers are uncovering unexpected sources of value and discovering agility.

Artificial Intelligence / Machine Learning

The promise of AI is coming into focus. Firms are moving beyond Robotic Process Automation (RPA) to new and exciting areas of machine learning. As it begins to enter its prime, we’ll explore AI’s adoption, use cases, and vendors.

Data and Analytics

Data is the still yet untapped source of value for banks and other capital markets firms. From strategy to tactics, we’ll explore the role and adoption of APIs in facilitating data flow, the part that external partners can play in monetizing data, and the pitfalls that banks and other capital markets firms should consider. We will also discuss the role of predictive analytics.

Model Awards

We’ve just closed nominations of exceptionally high quality. We’ll be assessing them shortly and developing case studies of the winners, culminating in the mid-April publication of reports from around the globe.

Contact us for more information about what we have planned in Q1.

If you are a client, please sign in to access a detailed view of our Q1 2020 agenda.