Achieving Holistic AML: Focus on Watchlist Screening

To avoid vulnerability to increasingly complex schemes, financial institutions and online services alike must achieve holistic AML to enable them to track customer and account activity across the enterprise.

Key research questions

- Why is holistic AML compliance needed today?

- How can firms build a 360-degree view of customer risk?

- Can holistic AML be achieved in a siloed, legacy environment?

Abstract

Now, more than ever, achieving a full, 360-degree view of customers is essential for holistic, optimized and effective anti-money laundering compliance.

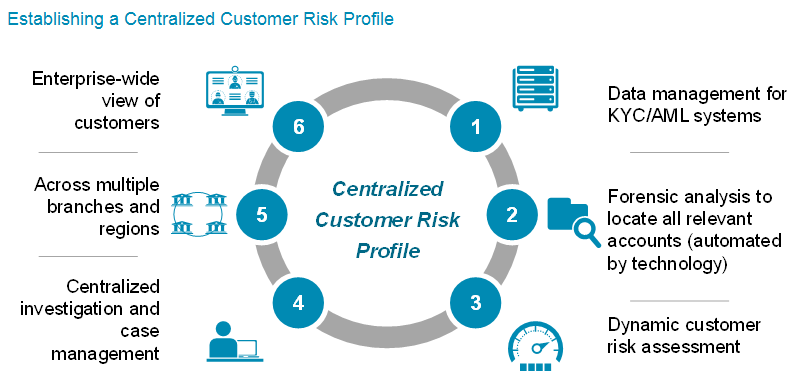

Modern financial services provide a ripe environment for money laundering schemes involving multiple customers, accounts, beneficiaries, delivery channels, and regions. Holistic AML mitigates risk by providing a 360-degree, enterprisewide view of customers as well as of networks of customers and accounts.

A new Celent report, commissioned by CSI, describes the need for holistic AML. Financial institutions and the services they offer both retail and corporate customers have grown in size and complexity in terms of lines of business, products offered, delivery channels including online and mobile, and regional and global footprints.

In addition, the rapid expansion of e-commerce, digital lifestyle services, and other online services is driving growth in online and in-app transactions and other new modes of transferring funds, introducing an entirely new realm of financial activity.

At the same time, in response to stricter regulation and more effective AML programs at financial firms, money laundering techniques have grown in sophistication in order to elude detection.

The complexity and reach of modern-day financial services provides the perfect terrain for money laundering schemes that use any combination of multiple customers, accounts, beneficiaries, products, financial firms, and regions. The rapidly expanding ecosystems of e-commerce and online financial services provide even more opportunity for moving and cleansing illicit money.

To meet these challenges, firms should implement a holistic approach to AML compliance in order to capture a consolidated and coordinated view of customers and activity across lines of business, products, and regions — including state and, for multinational institutions, national borders.