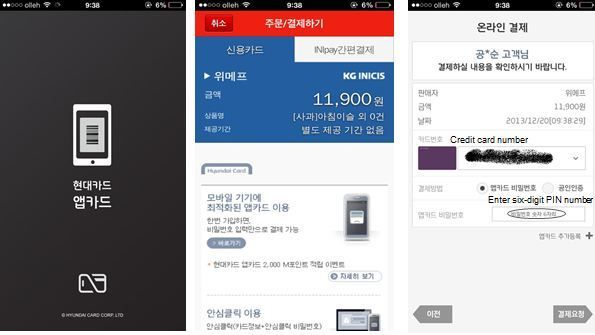

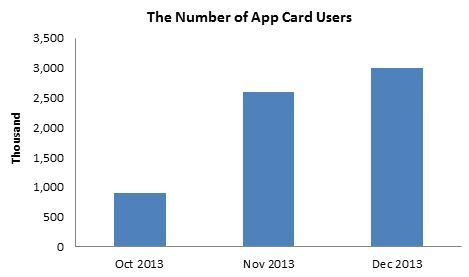

In 2013, South Korean payment industry entered a significant phase of payment. It is the introduction of App Card. App Card is the smartphone application which takes the place of plastic credit card and is used for both online and offline payment. In September 2013, six South Korean card companies including Shinhan Card, KB Card, Lotte Card, Hyundai Card, Samsung Card and NH Card collectively launched App Card. By the introduction of App Card, the process of smartphone shopping was streamlined. Previously, when a customer purchase something on smartphone with a credit card, they had to enter the credit card number every payment and PIN number and public key certificate were also required. The public key certificate should have been copied from the computer when a customer uses a credit card for smartphone payment at the first use. However, by using App Card, they can use smartphone payment with only six-digit PIN number after downloading the application and storing the credit card number to get started. Users don’t need to enter the credit card number on a smartphone every single payment.  This enhancement has been enjoying high popularity. For the first two months after the launch, the number of App Card users tapped 900 thousands and reached 3 million only for four months. Celent estimates that this growth will continue in 2014, albeit turning a little slower pace.

This enhancement has been enjoying high popularity. For the first two months after the launch, the number of App Card users tapped 900 thousands and reached 3 million only for four months. Celent estimates that this growth will continue in 2014, albeit turning a little slower pace.  Source: SBS This service cannot be used at a number of offline shops at the current moment but the number of acceptance of App Card is expected to expand in 2014. The growth of offline acceptance will bring swifter growth for App Card.

Source: SBS This service cannot be used at a number of offline shops at the current moment but the number of acceptance of App Card is expected to expand in 2014. The growth of offline acceptance will bring swifter growth for App Card.