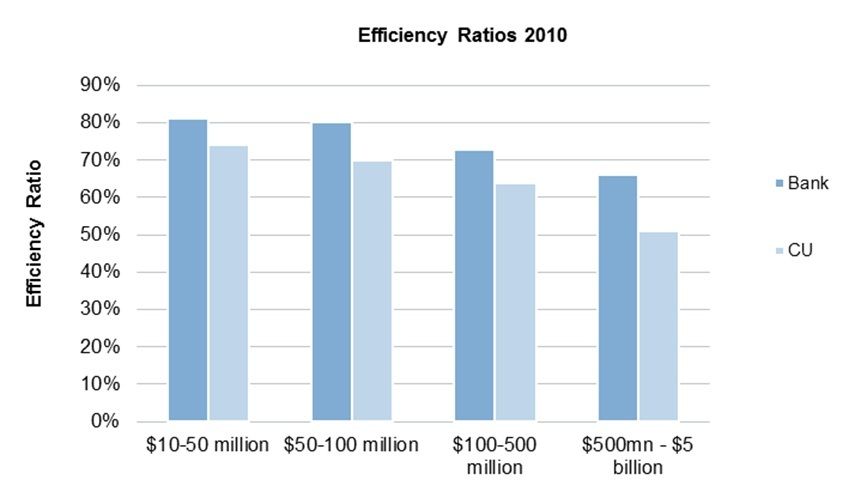

When Citibank announced they were moving from an internally developed core system to Systematics, I wondered why a bank would take all the trouble of doing a core banking migration, but not moving to a modern real-time system. http://bankingblog.celent.com/2010/02/citis-core-migration/The answer was that there would be too much operational risk in both moving to a new core system and changing the operations of the bank from batch to real-time. I just attended an announcement from BBVA and Accenture describing the deployment of the Alnova core banking system at BBVA Compass, the US subsidiary. The news is stunning. BBVA Compass has gone live with an overseas, real-time, modern core banking system for all deposit products.While savings and loans and credit unions have been running real-time core systems for years, commercial banks have stayed on batch / memo post. This has huge implications on both the customer experience and back-office operations. Banks no longer have the ability to sort transactions because they are processed as soon as they arrive. This will change overdraft revenues for those banks that sort from largest to smallest transaction before processing in the overnight batch. Processing in real-time also dramatically reduces or eliminates back-office overhead. One and done is the rule. Celent has noticed that credit unions have dramatically lower efficiency ratios than banks of the same asset size, and one of the contributing factors is that the credit unions are running running real-time systems. Please see the Celent report EfficienCU: An Examination of Bank and Credit Union Efficiency Ratios by Asset Tier, November 2011 for more details.BBVA is thinking boldly about the US market. They believe that underinvestment by US banks in modern core banking technology has created an opportunity for them to exploit. Virtually every commercial bank in the United States has a batch memo post system with product siloed (as opposed to customer centric) architecture. Each channel is managed separately and plugs into the core independently. BBVA believes that by creating a business that is customer centric, multichannel, real-time, with straight through processing and related lower cost, they can make even greater inroads into the US banking market. The goal is to have an improvement in their efficiency ratios of 10% in the midterm. This is shy of the efficiency advantage credit unions have over banks: [caption id="attachment_3253" align="alignleft" width="850"] Credit unions enjoy an efficiency advantage over banks.[/caption] They already have a top 25 US bank. If BBVA is able to reduce costs through real-time processing and better deployment of cost-saving channels, other banks will be in trouble. If BBVA can also develop customer centric pricing and use that to gain share, other banks will be in deep trouble. This announcement puts Accenture in the cat bird seat. They own the Alnova software asset and have demonstrated the ability to deploy the overseas real-time system in the United States at a commercial bank. This is not easy. There have been notable failures by other vendors in the recent past. Any bank looking to make the leap to a real-time customer centric system will likely look very hard at Accenture.Another bank, famous for its real-time core processing is Santander, BBVA's Spanish competitor. They have an internally developed core system called Parthenon that they deployed quickly in the UK after acquiring of Abbey National, Alliance & Leicester and Bradford & Bingley. This rapidly drove down operating cost in the UK acquisitions. Santander owns Sovereign Bank in the US which is moving at least in part to the Parthenon system.It seems that these two Spanish banks understand the value that modern technology can play in making a bank cost effective and customer centric. They learn these lessons in Spain, but will be teaching them in the US.

Credit unions enjoy an efficiency advantage over banks.[/caption] They already have a top 25 US bank. If BBVA is able to reduce costs through real-time processing and better deployment of cost-saving channels, other banks will be in trouble. If BBVA can also develop customer centric pricing and use that to gain share, other banks will be in deep trouble. This announcement puts Accenture in the cat bird seat. They own the Alnova software asset and have demonstrated the ability to deploy the overseas real-time system in the United States at a commercial bank. This is not easy. There have been notable failures by other vendors in the recent past. Any bank looking to make the leap to a real-time customer centric system will likely look very hard at Accenture.Another bank, famous for its real-time core processing is Santander, BBVA's Spanish competitor. They have an internally developed core system called Parthenon that they deployed quickly in the UK after acquiring of Abbey National, Alliance & Leicester and Bradford & Bingley. This rapidly drove down operating cost in the UK acquisitions. Santander owns Sovereign Bank in the US which is moving at least in part to the Parthenon system.It seems that these two Spanish banks understand the value that modern technology can play in making a bank cost effective and customer centric. They learn these lessons in Spain, but will be teaching them in the US.