Platform Wars: End-to-end, Portfolio Management, and Point Systems Face Off

Abstract

The advantages of scale and integration long enjoyed by end-to-end wealth management platform vendors are under assault by the shift to digitization and a lighter architectural footprint. Aging technology represents an Achilles heel for these vendors, given the servicing needed to keep national broker-dealers onboard. These marquee clients know their strategic value to the vendors, who will resort to price concessions to retain them.

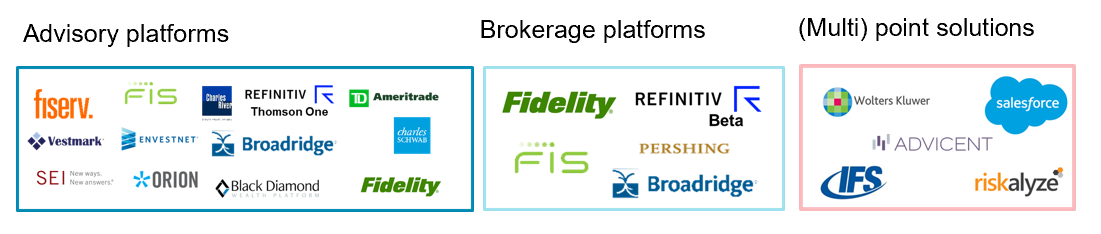

Competition among major vendors is mirrored by the efforts of smaller players to bootstrap themselves into the big leagues. So-called point solutions have long been visible in the independent market, particularly in the world of the Registered Investment Advisor (RIA), where the diversity of investment philosophies lends itself to more focused tech relationships. The growth of the independent market and its parallel professionalization in the form of the corporate RIA have encouraged vendors to extend their functionality across the value chain. Firms like Riskalyze are building out full-scale investment management solutions, with others like Orion evolving into something close to end-to-end platforms. These “multi-point” vendors are leveraging API connectivity and elastic pricing to hunt quarry in the brokerage market.