Insurance Data Mastery Solution Spectrum

Abstract

In the broad space of data mastery, where insurers may turn to many vendors for help, understanding each vendor’s solution in the context of a specific initiative is a challenge.

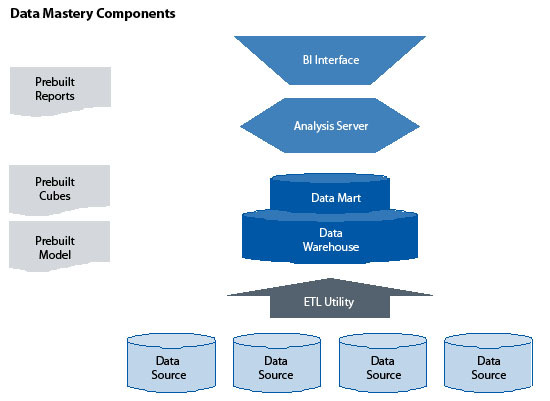

The phrase "data mastery" covers a broad range of technology solutions, including data warehouses, data marts, extract, transform, load (ETL), customer relationship management, unified presentation layers, and business intelligence. Good data mastery will help a company find areas for increased efficiency and cost reductions. When all signs point to an increase in industry regulation, a good solution to view and understand data will be crucial for compliance.

In a new report, Insurance Data Mastery Solution Spectrum, Celent profiles and positions 24 vendor solutions. Details on each vendor’s solution are presented in short profiles designed to help insurers quickly assimilate information about this complex space in order to determine which vendors are likely to be relevant to their specific initiatives.

"Many data mastery projects undertaken by insurers do not necessarily end in failure, but they do not achieve the end goals of true business intelligence," says Jeff Goldberg, senior analyst with Celent’s insurance group and author of the report. "Working with a vendor does not mean an insurer gives up control over the domain content. A good vendor will make it easy to customize business intelligence content for a particular company’s needs."

This report is designed to help insurers understand the general "vendor space" for data mastery solutions and to provide an overview of the capabilities, areas of focus, and characteristics of leading solutions. The report is a companion to a recent report, Insurance Data Mastery Strategies.

The 50-page report contains 24 vendor profiles, five figures, and one table. A table of contents is available online.

of Celent's Life/Health Insurance and Property/Casualty Insurance research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.