London, United Kingdom 13 June 2008

Celent presents the strategic underpinnings and best practices for optimizing control functions within financial institutions.

The torrent of regulation since the turn of the decade has been keeping financial institutions arduously engaged in risk and compliance related initiatives, often characterised by overinflated budgets. However, despite intentions to manage the heavy workload of regulatory projects over the past years, the pressures to govern and manage risks have escalated and are continuing to escalate.

The subject of control function efficacy has come back on to the examination table at senior executive levels, driven by substantially increased sensitivity to governance issues, changing "regulatory dynamics," external pressures, internal demands, and severe economic consequences from control failures. In a new report, , Celent advises firms to be cognizant of the required underpinnings for control-related activities, and presents best practices for financial institutions to optimize their control functions.

"Despite multiple pressure points, for many firms, approaching the subject of optimizing internal control functions presents them with a delicate rope to walk on. There is a real fear among executives that if costs and efficiency are emphasized, the reliability of control activities will be compromised," says Cubillas Ding, Celent senior analyst and author of the report.

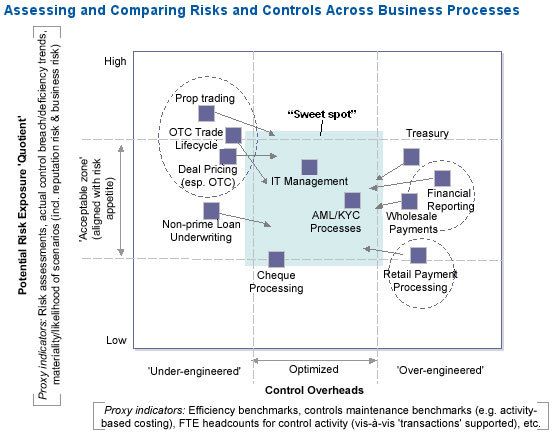

The balance between the three variables in streamlining control functions...namely, the preservation of integrity, the reduction of costs, and the increase in efficiency...needs to be carefully maintained. "Locating and hitting the ‘sweet spot’ is seldom straightforward, and firms need to adopt a firm-wide approach in assessing control functions," Ding notes.

"Overall, the starting points for re-evaluating controls should not only be to improve efficiency but also to foster firmwide control capabilities which are lean and strong, yet do not hinder the mandate and strategic foundations for specific business lines and support divisions," he adds.

Under the scrutiny of regulatory stakeholders, and in meager times especially, achieving a lean and strong posture is becoming a defensive necessity that forward-thinking firms need to embrace. Market forces are making it less of a luxury. The aims of streamlining should not only be to make control functions more efficient but also to optimize their scope and depth, in order to plug existing gaps and ensure that they continue to be fit-for-purpose.

The 38-page report contains 13 figures and 8 tables. A table of contents is available online.

Members of Celent's Finance, Risk & Compliance research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.