Core Banking in Latin America: Global Vendor Edition, 2017

The core marketing in Latin America is dynamic, shaped by growing consumer demands around digital delivery.

Key research questions

- What are the trends affecting the core banking systems market?

- Does the client count of a solution reflect its competitiveness?

- Does a single “best” core banking system exist?

Abstract

Latin America is a distinct market for core banking, with particular vendor dynamics. Big wins can result in a long and profitable relationship, and so the core market is highly strategic.

While local vendors have had the most success, international vendors are trying to forge new relationships at all tiers. Understanding the market, as well as the major players, is important.

This report will focus on the global vendors in the market.

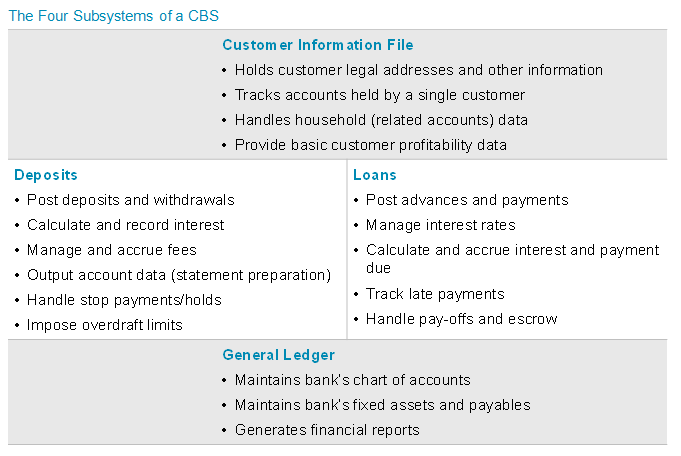

The core banking platform is the primary system of record for the accounts of a bank, and is arguably the most important technology component of any institution. Because of this, the decision to change it can be difficult. The process of switching out a core system has been likened to changing the engine on an aircraft in flight. These transformations can be costly and risky. It’s important that institutions choose the right vendor.

The complexity of transformation means that many banks are running systems that are decades old. In the last 10 years, the rise of digital and the evolution of delivery channels have added stress to these platforms. Needs have evolved, and some financial institutions are finding their core systems ill-equipped to meet today’s requirements. While technology adaptations have allowed banks to stave off full-blown core replacement, many institutions are reaching the breaking point, opting to transform their legacy core system.