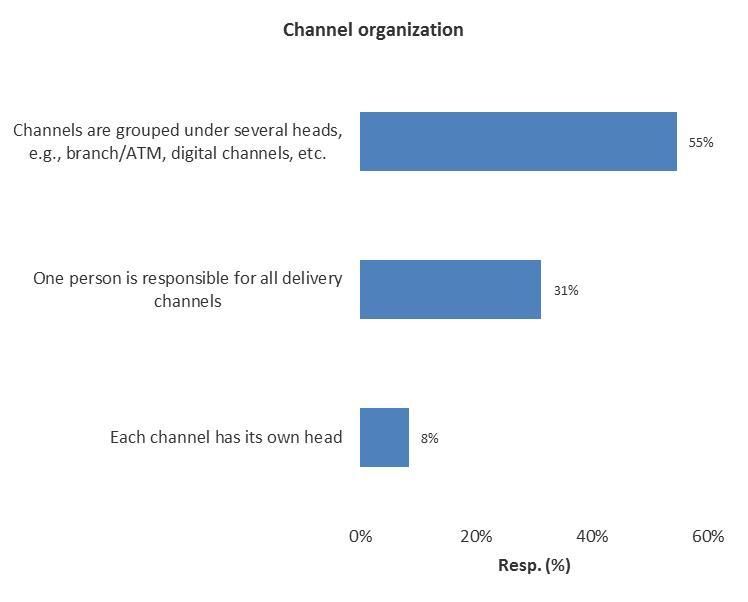

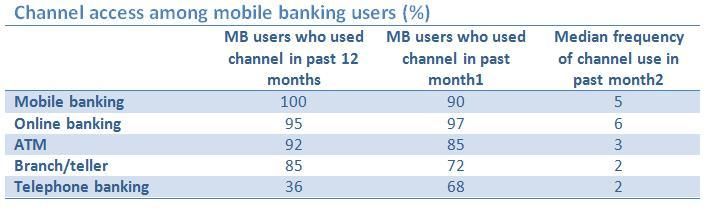

*As mentioned in an earlier blog, the persistence of the “branch is dead” debate seems to be to betray the deeply invested interests on each side of the debate. In many financial institutions, digital and physical channels still have separate reporting structures (Figure 1). In Celent’s October 2014 survey of North American financial institutions, we found that less than a third of responding FIs have a single person responsible for all delivery channels. Interestingly, this appeared to be more likely among large banks.  Another observation is that much of the debate is deeply polarized – all or nothing – as if banks serve a static and homogeneous market. Neither is true. Most banks serve a diverse client base whose needs and preferences are in a state of change. Niche players, such as Moven, can take a more polarized (or shall we say extreme) position. A third (and my favorite) observation is that all too often, inaccurate assertions are made about channel usage as if demographics were a sole and causal determinant. We hear it all the time; “Millennials don’t use branches.” “Old people don’t use digital channels” and so on. In March, the US Federal Reserve published its third instalment of comprehensive consumer research on the topic, Consumers and Mobile Financial Services 2015. It makes for insightful reading. One myth the report busts is that digitally driven consumers have little use for other channels. Nothing could be farther from the truth - at least for the present. The survey (an online survey administered with a managed panel of nearly 3,000 consumers designed to be representative of the U.S. eighteen and over population) sought to understand how mobile banking users (35% of the panel, up from 30% in 2013 and 26% in 2012) used other channels. The results may surprise you. A few tid-bits:

Another observation is that much of the debate is deeply polarized – all or nothing – as if banks serve a static and homogeneous market. Neither is true. Most banks serve a diverse client base whose needs and preferences are in a state of change. Niche players, such as Moven, can take a more polarized (or shall we say extreme) position. A third (and my favorite) observation is that all too often, inaccurate assertions are made about channel usage as if demographics were a sole and causal determinant. We hear it all the time; “Millennials don’t use branches.” “Old people don’t use digital channels” and so on. In March, the US Federal Reserve published its third instalment of comprehensive consumer research on the topic, Consumers and Mobile Financial Services 2015. It makes for insightful reading. One myth the report busts is that digitally driven consumers have little use for other channels. Nothing could be farther from the truth - at least for the present. The survey (an online survey administered with a managed panel of nearly 3,000 consumers designed to be representative of the U.S. eighteen and over population) sought to understand how mobile banking users (35% of the panel, up from 30% in 2013 and 26% in 2012) used other channels. The results may surprise you. A few tid-bits:

- Between 2011 and 2014, mobile banking usage has grown strongly across all age groups. Among 60+ consumers, usage has nearly tripled.

- Hispanics reported the highest incidence of P12M mobile banking usage (53% of those having bank accounts, compared to 39% in the overall sample).

- While mobile banking users are using the platform frequently and consistently, they also interact with their banks through more traditional branch and ATM channels. 72% of mobile banking users frequented a branch in the past month.

*1 Of those who used channel in past 12 months *2 Of those who used channel in past month Separately, respondents were asked to rank the three main ways they interact with their bank or credit union. 21% of mobile banking users ranked the mobile channel first. 13% ranked the branch first. Two implications from the diversity of channel usage that characterizes today's consumers:

*1 Of those who used channel in past 12 months *2 Of those who used channel in past month Separately, respondents were asked to rank the three main ways they interact with their bank or credit union. 21% of mobile banking users ranked the mobile channel first. 13% ranked the branch first. Two implications from the diversity of channel usage that characterizes today's consumers: - Omnichannel is a legitimate pursuit. All channels need to be optimized.

- Banks neglect the branch channel at their peril.