Trends among major financial institutions and financial technology vendors in Japan portend the arrival of an era of new competition and cocreation among infrastructure players in the retail payment service sector.

In this series, Celent examines Japan's payment infrastructure from four perspectives: A) payment instruments and channels; B) bank-provided corporate payments (wholesale payment services, large-value services); C) bank-provided retail payments (retail payment services [including retailers] and small-value payments services); and D) a look at the financial market infrastructure (FMI) against the backdrop of the various payment service offerings and competitive conditions.

In setting the stage for this report, Part 1 of this series examined the Zengin System (the national bank data communication network system) and Part 2 undertook an examination of the Bank of Japan Financial Network System (BOJ-NET). Part 3 focused on the issue of wholesale payments in Japan, in other words, large-value corporate payments.

Part 4 of this series examines developments in the diversification of payment instruments and channels, especially trends in payment services for retail customers (namely small-value and retail payment services) coupled with an analysis of up-and-coming operators and trends in technology usage. First, the report takes a look at the overall retail payment market and its incipient transformation. The report offers a bird’s-eye market overview and dives into developments in cashless initiatives in the retail payment market, before summarizing with a look at the current situation and the national growth strategy. Next, the report considers trends in emerging technology and alternative players. After analyzing cashless payment services and businesses as well as related technologies, the report distills the latest in strategic market initiative cases of new payment service efforts offered by leading Japan payment service companies. The report concludes with the outlook for the future of payment infrastructures.

The fundamental structure underpinning the retail payment landscape has yet to change.

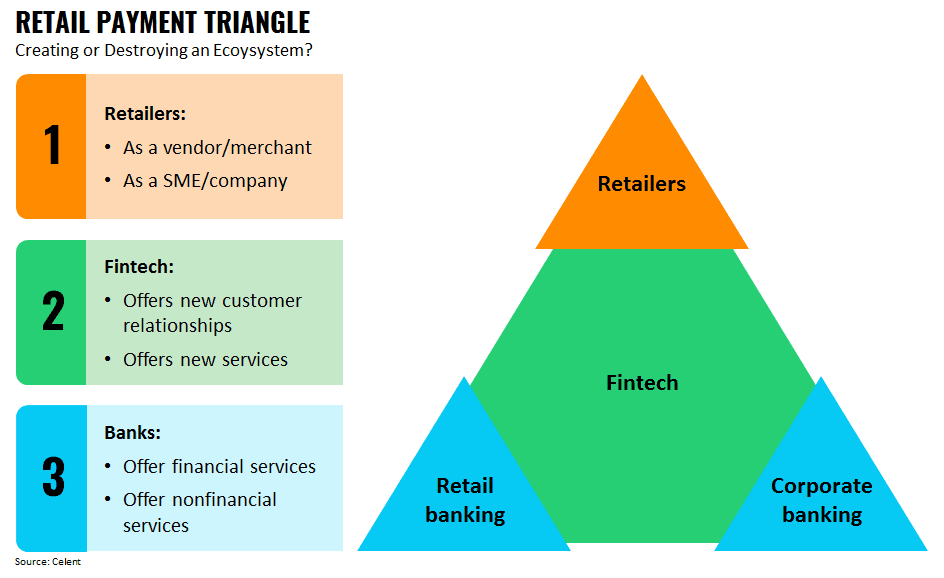

Many retailers in Japan are vendors and many are SMEs. For these businesses, growing sales is the top priority. At the same time, surveys of SME business operators indicate that they have various underlying concerns that are both financial and nonfinancial in nature. Celent's SME market survey has shown that one challenge faced by SMEs is a growing gap between their needs and financial institution offerings. Apart from growing sales, existing shops and businesses indicated a strong interest in enhancing their overall business activities with digital platforms. Capital procurement provides one example. Indeed, more than 50% of SMEs surveyed indicated they are seeking new lines of credit online. Yet, only approximately 20% of SMEs have applied online for loans or financing. In terms of improved cashflow, SME interest in and use of online accounting solutions is on the rise; however, accounting software and banking services are not linked. For overseas transactions, businesses are eager for standardized cross-border solutions that are easy to use and inexpensive. They would like nonbanking solutions or advisory services to overcome the challenges related to overseas purchasing, seller networking, logistics, and legal/customs documentation, but their banking partners lack such menu offerings.

In a sense, what fintech brings to the table is clear: new value propositions that leverage new customer relationships and services seeking to insert themselves between retailers and banks. This means new mobile and online-driven remittance and QR code payment services based on new customer relationships, against a backdrop of corporate social networking service (SNS) activities and e-commerce customers. The challenge is how to monetize that value proposition. So far, Japanese fintech companies have proposed new pricing approaches such as freemium, premium, and subscription. These have yet to bring benefit to their bottom lines, putting these payment services and financial services at the stage of investing in hope of a future payoff.

At issue is whether banks consider this new triangle—of retailers, fintech, and financial institutions—to be a threat that will erode their market position as an incumbent player or an opportunity to build a new ecosystem. Currently, the positions of major financial institutions and technology vendors seem to be premised on the existing ecosystem, aspiring to become purveyors of new payment services with designs on becoming providers of wholesale payment services (payment service platformers).