市場における困難な課題

リスク中心の規制や市場構造に関する規制に伴い、より複雑な要件が増え続けていることから、サイロ化した組織やシステムの枠を越えた統合と情報の整合性の確保という課題が生じている。同時に、監督業務、リスク管理、コンプライアンス管理のパラダイムも進化し、従来の法令によってリスク管理やコンプライアンスを義務付ける手法は影をひそめ、リスクに基づくアプローチが主流となっている。後者は、高リスクを負っている、あるいはシステム上重要な金融機関、適正な行動、差し迫ったシステミック・リスクをより重点的に監督する方法である。

規制要件への対応が不十分であれば、最適な結果は望めない。それどころか、システムインターフェースの重複、複雑なアプリケーションやデータの依存関係、不完全な監査記録、および広範な変更管理の問題を原因に、不分な対応によってオペレーショナル・リスクが高まり、コストが増加する。その結果、市場参入に重大なリスクとコストが発生し、企業はこれらに対処しなければならない。

差別化されたソリューション・パラダイム

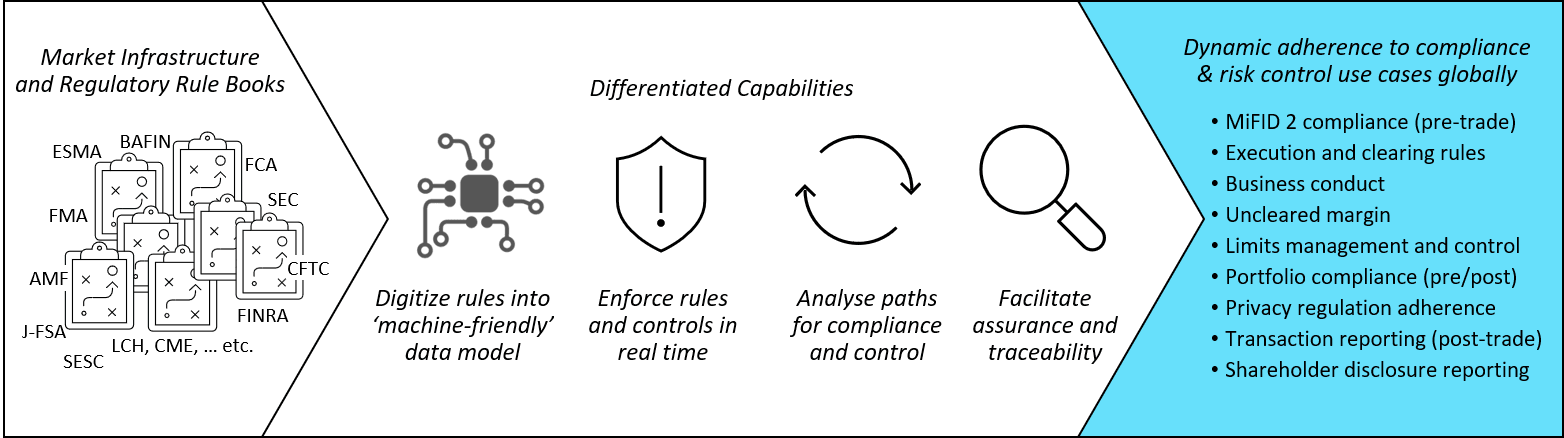

セレントはDroit Financial Technologies社との最近の議論において、プレ/ ポストトレード・コンプライアンス、特にブローカーディーラー、取引所、およびポストトレード・ユーティリティーサービス事業者向けのイニシアチブ、特に大口のキャピタルマーケッツ関連トランザクションアクティビティの規制管理の実績を聴取した。

銀行、ブローカーディーラー、保険会社、ウエルスマネージャーおよび投資運用会社は、情報の提供や各規則の施行に加え、トレーディング、リスク管理、法規制遵守および財務報告の作成プロセスに関して、より協調的で合理的な体制を目指しているため、本レポートでは、革新的な手法とテクノロジーによって、どのように、あるいはどの分野に、規模の拡大、コスト削減、更には法規制遵守のダイナミックな制御の可能性がもたらされるのかについて、展望を示す。

本Solution Briefでは、Droitのアプローチが一般的なアプローチとどのように異なっているのか、また、トランザクション監視、コンプライアンス管理および規制報告のソリューションに関連する従来のアプローチ(直接的には比較できないが)をどのように上回っているのかについて検証する。規制要件を「機械処理可能」な情報に変換する機能の他に、規制対象企業は”control-as-a-service”提供モデルと疎結合のIT統合アプローチを採用することで、短中期的にオペレーショナル・コストの最適化、実装のしやすさ、”time-to-value” (価値を実感するまでの時間) の短縮を実現できる可能性がある。

つまるところ、義務、必要性あるいは戦略的目標のいずれが理由であれ、企業は規制、リスク、ガバナンス慣行を定義する方法だけでなく、それ以上に重要なこととして、実証的かつ効果的に変化に対応する方法についても、変化を迫られている。リアクティブな戦略、一貫性のない対応、「必要最低限」の戦術的アプローチでは、もはや十分とはいえない。この状況を前向きに受け入れる企業のために、よりスマートな方法が登場している。