クリプト・カストディ

セレントが発表した最新のレポートシリーズの第1弾は、パブリックブロックチェーンを使った新たな金融インフラおよびイノベーション・エコシステムの構築の可能性を検証するための基盤となるだろう。

暗号資産およびデジタル資産に付随するリスク、規制、保険および受託者義務に関する課題を具体化させる上で、カストディは重要なカギを握っている。そのため、秘密鍵を保護する適格カストディアン向けのカストディソリューションの登場は、既存の金融機関に新たなパートナーシップやビジネス機会をもたらすインフラ基盤を提供することになる。

デジタル資産の基盤

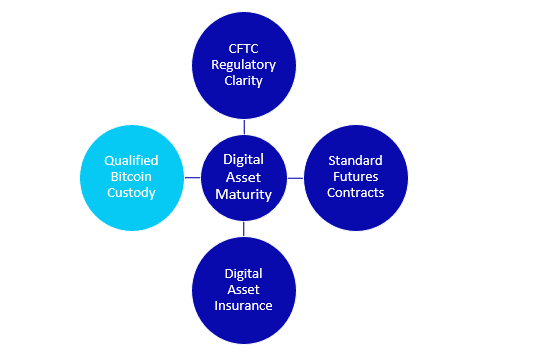

セレントは以前、暗号資産の4つの重要な基盤である①商品先物取引委員会(CFTC)の規制の透明化②ビットコインによる先物契約の標準化③第三者保険④適格カストディアン―が全て整ったとの見方を示した。

このうちカストディは重要インフラであり、ビットコインなどのデジタルベアラー資産がカストディにもたらす重要課題を解決したり、こうした資産クラスの制度化を促す可能性がある。

新しいビジネスモデルと収益機会

暗号は独自の特性を持つがゆえに、暗号資産のカストディは特有の課題に直面している。ここ数年、関連するエコシステムはこれらの課題解決に向けた取り組みを加速させてきた。

今は時代の転換点にあり、既存の金融機関にとっては、新たなカストディソリューション(導入モデルの柔軟性が高く、ガイドライン順守のためのカスタマイズ化がしやすい)の導入により、慎重かつ制御された方法で暗号またはデジタル資産戦略を策定する方向へと舵を切るチャンスが到来している。

2020年4-6月期以降は、適格カストディアン向けソリューションの導入によって暗号通貨の信頼性が高まるとみられることから、既存の金融機関の提携をめぐるビッグニュースが相次ぐことになろう。

これは、新たな資産クラスから新しい収益およびビジネスモデルを確立する貴重なチャンスとなるだろう。

(詳しい情報は、セレント北川俊来TKitagawa@celent.comまでお問合せください)