COVID-19 Pulse Survey of US Financial Institutions

Abstract

In the wake of the Federal government’s declaration of a national emergency on March 13, 2020, Arizent set in motion a series of monthly research surveys to help the communities it reaches navigate the COVID-19 crisis, including subscribers to American Banker. This report analyzes responses from the fourth in the series, a survey conducted in partnership with Celent. The primary objective was to better understand the extent of the expected disruption in customer interactions from COVID-19 and how businesses are responding to the resulting challenges and opportunities.

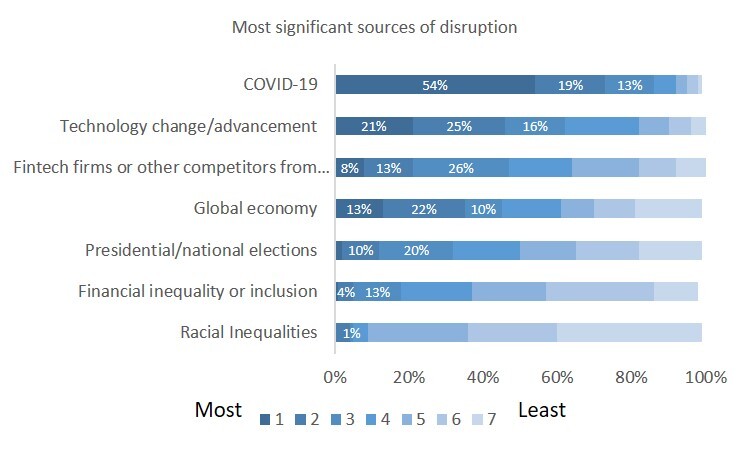

Institutions of all sizes and types see COVID-19 as a massively disruptive event resulting in significant and permanent change. Moreover, by more than a 2:1 margin, banks feel COVID-19 will have been more disruptive than technology change, the #1 disrupter before the pandemic.

Banks have been particularly challenged with effectively engagaing customers during the pandemic. There is broad agreement that customer engagement will continue to be digitally-driven. For example, 90 percent of surveyed institutions agree with the statement, “Firms that excel in both digital and in-person human-to-human customer engagement will win in the ‘new normal’.”

Yet few are acting accordingly. Banks diverge massively in the extent to which they are equipped to do so (percentage of banks implementing) as well as the sense of urgency to be so equipped (percentage of banks planning to implement). Compared to larger banks, most community financial institutions (CFIs) underappreciate the importance of digital customer engagement and few have plans to implement relevant technologies in the near term.

Said another way, most CFIs are glaringly out of step with the seismic changes underway and accelerated by the pandemic.