The collapse of Silicon Valley Bank and First Republic Bank in North America in the spring of 2023, the disappearance of Credit Suisse in Europe, and further financial failures represent a series of major threats to the ability of financial institutions to conduct their operations without interruption.

The past 25 years have also seen the 9/11 attacks in 2001, the global financial crisis in 2008, the flash crash in 2010, the sovereign debt crisis in 2012, the Bangladesh bank heist in 2016, and the global pandemic in 2020, each of which significantly threatened the viability of financial services. In 2022, regulators around the world began to take steps to instill greater operational resilience throughout the financial services sector to deal with unforeseen systemic risks.

Regulations vary from region to region, but they all mandate an integrated risk management approach that combines multiple aspects of operational risk into a single framework, identifies critical business services, and identifies how to respond in the face of a system failure with enterprise-wide agreement.

Financial institutions need urgent and significant assistance in transforming their risk capabilities, as many regulators are calling for enhanced processes and systems by 2025. Many financial institutions are realizing that a higher level of collaboration is needed across the enterprise to meet regulatory requirements. Financial institutions need to improve both enterprise-level visibility into risk and compliance activities and enterprise-level crisis response capabilities.

This report discusses the latest Celent research findings on the following trends for the APAC/Japan market.

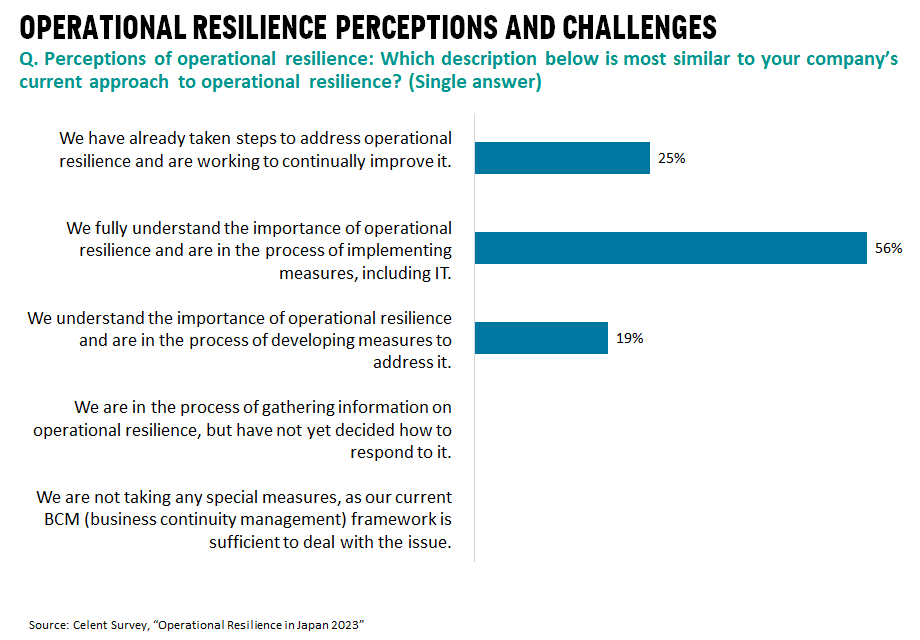

- New Regulatory Trends: What operational resilience (OR) is, how it’s perceived, and what its challenges are.

- Responses and Strategies: IT and operations management’s initiatives, key agendas, and priorities.

- Recommendations: The art of deploying BCM (business continuity management) to OR.