Currency automation has long left the confines of bank branches and cash vaults, onto the customer’s premise. But utilization has been historically limited. Will new solution offerings and banks’ growing desire to migrate transactions out of the branch put new life into remote cash capture?

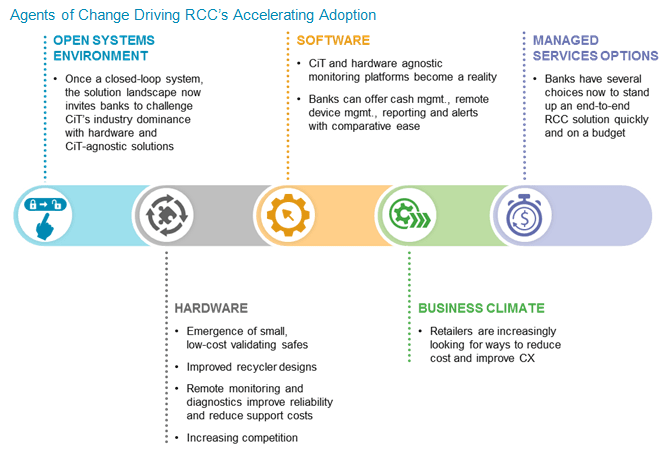

This comprehensive primer on remote cash capture provides an analysis of significant changes in the market that Celent believes will lead to increased merchant adoption of cash automation solutions and increased opportunity for banks and solution providers that participate in the value chain. In particular, there is a step-change in the opportunity for banks to stand up bank-led solutions rather than being simply a provider of provisional credit to solutions brought to market by the big four armored couriers.