New York, NY, USA December 11, 2008

Flawed Assumptions about the Credit Crisis: A Critical Examination of US Policymakers

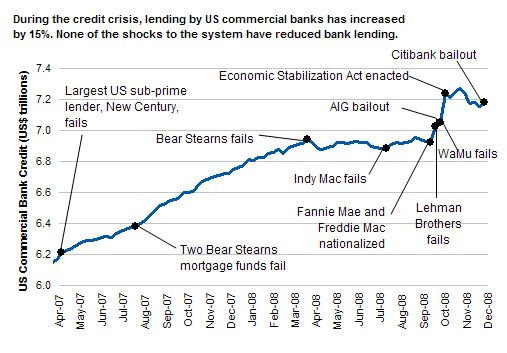

US policymakers have implemented an unprecedented range of tools to fight the credit crisis. However, it appears that many of their assumptions regarding the nature of the crisis are not supported, or even flatly contradicted, by the available data. Many measures of lending have actually increased during the crisis and are even at record levels.

This reports examines some key assumptions being made by leading US policymakers regarding the credit crisis. In particular, comments made by the two leading policymakers, the chairman of the Federal Reserve, Ben Bernanke, as well as the secretary of the US Treasury Department, Henry Paulson, are compared with publicly available data.

In many cases, it appears that these policymakers’ assumptions regarding the credit crisis are incorrect. Far from seeing a tightening of credit, a number of measures show that credit has expanded, and Celent finds that the lending markets are in surprisingly good health. Data published (in most cases by the Federal Reserve itself) show that:

- Overall lending by US banks is at a record high and has increased during the credit crisis.

- Interbank lending is at record highs and has increased during the credit crisis.

- Consumer credit is at record highs and has increased during the credit crisis.

- Commercial paper markets are operating within their historical norms.

- Lending by banks to businesses is at record highs and has been growing rapidly.

- Municipal bond markets are operating within their historical norms.

- Deposits at banks have shown a substantial increase since the start of the credit crisis.

"It appears that policymakers are making a variety of mistakes regarding the current financial crisis. If that is the case, the policy tools that they are employing may very well be the wrong ones," Octavio Marenzi, head of Celent and author of the report.

The 30-page report contains 27 figures. A table of contents is available online.

of Celent's research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.