キャピタルマーケッツ・オペレーションにおいて、照合は極めて重要な業務の1つである。照合が正しく行われなければ損失が発生し、最善の資本運用ができず、罰金を課せられるほか、それによって評判リスクを招く恐れもある。そのため、照合はコストや効率性の問題だけにとどまらず、オペレーショナルリスクに係る問題でもある。規制改正や市場構造の変化を背景に、照合をめぐる課題は増えつつある。さらに最近では、新型コロナウイルスのパンデミックに伴う人手不足やリソースの逼迫が問題を悪化させており、キャピタルマーケッツの参加企業は照合プロセスの自動化や効率化の加速を迫られている。

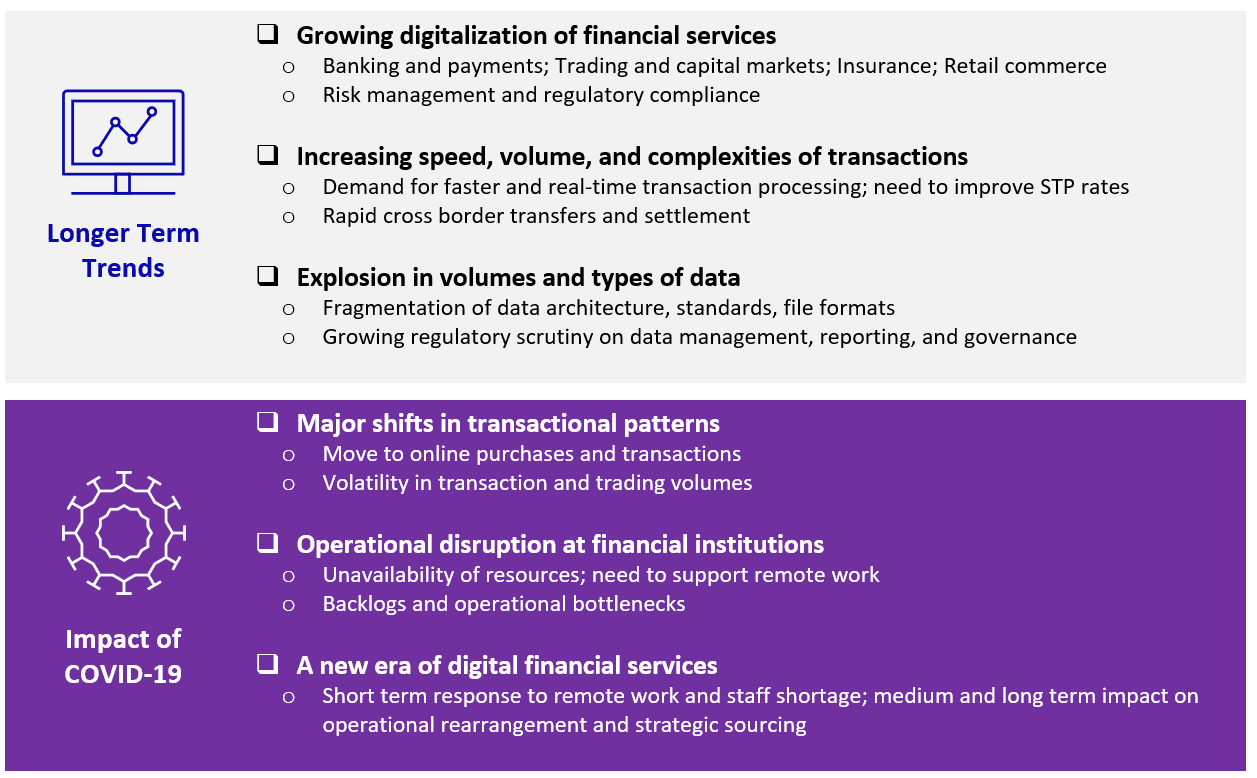

COVID-19により、デジタル化が加速され、照合の精査が強化されている。

Source: Celent

照合に使われるテクノロジーソリューションを取り巻く状況は複雑で多様化している。ソリューションにはイベントドリブン型のマニュアル処理、エクセルベースの基本ツール、自社開発によるレガシーシステム、主にルールドリブン型のサードパーティ・ソフトウェアなどが含まれ、最近ではAIやMLなどの次世代テクノロジーを使ったソリューションも出てきている。

キャピタルマーケッツでは、サードパーティの照合ソリューションを採用する動きが広がっている。この分野のベンダー市場にはバックグラウンド、成熟度、価値提案、テクノロジーの性能、プライスポイントなどが異なる複数のプレーヤーが参入し、競合している。本レポートでは、多様なプレーヤーの提供する21のソフトウェアソリューションを取り上げる。具体的なプロバイダーはAutoRek、Broadridge、Duco、Electra Reconciliation、EZOPS、Finastra、FINBOX SOLUTIONS、FIS、Fiserv、Gresham Technologies、Infosys、Intellect Design Arena、IHS Markit、London Stock Exchange Group (UnaVista)、Operartis、ReconArt、SmartStream、SS&C Advent、TCS、TookitakiおよびTorstoneである。また、ITサービスプロバイダーのWiproが行っている顧客固有の取り組みも紹介している。

顧客ニーズの拡大、市場での競争激化、テクノロジーの発展がベンダーソリューションの進化と近代化を促すなか、ソリューションの特性、機能および性能は今後も拡充が続くだろう。その中で重要性を増しつつあるテーマとして、①クラウドの利用拡大による総保有コストの低減②合理的な自動化技術の活用による効率性の向上―の2つが挙げられる。アドバンスト・アナリティクスは既存システムの大幅なパフォーマンス向上に有効であるため、さらに導入が加速するとみられる。少なくとも今後3年間は、既存システムの置換ではなく、AIやMLを活用したシステムとルールベース型システムを併用することで現行システムの拡大と強化が図られることになるだろう。

今後はテクノロジーの所有コストの重要性が増し、キャピタルマーケッツの参加企業は常に変化する市況や制度に対応できる柔軟で機敏な業務の確立に注力することになろう。クラウドおよびAPI技術は、これらの目標を達成する上で重要な役割を果たすだろう。また、それらはインテリジェント・オートメーション技術の利用拡大にも寄与するとみられる。AIの運用には、オンデマンドで高度な演算能力が必要になるからだ。

キャピタルマーケッツの参加企業が社内のITプロジェクトのコスト削減と期間短縮を目指すなか、セルフサービス機能の拡大ニーズも高まるだろう。特に需要が大きいのは、ビジネスユーザーが提携先のベンダーや社内のIT部門に依存することなく、迅速かつ簡単に照合機能のオンボーディングやメンテナンスを行えるソリューションの需要が高まるだろう。

(詳しい情報は、セレント北川俊来TKitagawa@celent.comまでお問合せください)