A Future for In-branch Self-service?

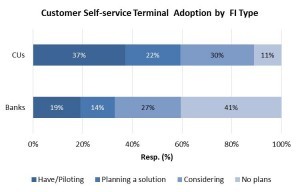

Credit unions are leading in in-branch self-service[/caption] From our research, when executed well using capable deposit automation and cash recycling devices, in-branch self-service can result in multiple benefits, including: • Reduced cost-to-serve • Extended service hours • Reduced cash handling costs • Fewer errors, fewer exceptions • Demonstrably improved customer satisfaction • Improved sales results ATM Marketplace posted an article extolling the virtues of in-branch self-service at BAWAG P.S.K., Austria's fifth largest retail bank. There are, of course, many ways to skin a cat. We found the use of in-branch self-service at BAWAG P.S.K. straightforward. More interesting is its use within Austrian Post Office facilities (or is it vice versa?). Celent’s 2012 Model Bank of the Year, RHB Bank (Malaysia), was so honoured for its innovative and effective launch of Easy by RHB, which deployed multiple Retail partnerships to lower costs and deliver prime retail placement. These included partnerships with Tesco and the Malaysian equivalent of the U.S. Post Office, POS Malaysia. That concept (below) also includes in-branch self-service, but the devices are not apparent in the picture.

Credit unions are leading in in-branch self-service[/caption] From our research, when executed well using capable deposit automation and cash recycling devices, in-branch self-service can result in multiple benefits, including: • Reduced cost-to-serve • Extended service hours • Reduced cash handling costs • Fewer errors, fewer exceptions • Demonstrably improved customer satisfaction • Improved sales results ATM Marketplace posted an article extolling the virtues of in-branch self-service at BAWAG P.S.K., Austria's fifth largest retail bank. There are, of course, many ways to skin a cat. We found the use of in-branch self-service at BAWAG P.S.K. straightforward. More interesting is its use within Austrian Post Office facilities (or is it vice versa?). Celent’s 2012 Model Bank of the Year, RHB Bank (Malaysia), was so honoured for its innovative and effective launch of Easy by RHB, which deployed multiple Retail partnerships to lower costs and deliver prime retail placement. These included partnerships with Tesco and the Malaysian equivalent of the U.S. Post Office, POS Malaysia. That concept (below) also includes in-branch self-service, but the devices are not apparent in the picture.  Retail partnerships appear less polarizing than in-branch self-service in banking. Witness the thousands of in-store branches. Honestly though, most implementations are traditional and, well – boring. Easy by RHB offers an engaging and also wildly successful alternative – one deserving consideration as financial institutions struggle with branch channel costs and eroding relevance in the “new normal” of retail banking. Celent is welcoming submissions for Celent Model Bank 2013 through 30 November 2012. Submissions are made online at http://www.celentmodelbank.com.

Retail partnerships appear less polarizing than in-branch self-service in banking. Witness the thousands of in-store branches. Honestly though, most implementations are traditional and, well – boring. Easy by RHB offers an engaging and also wildly successful alternative – one deserving consideration as financial institutions struggle with branch channel costs and eroding relevance in the “new normal” of retail banking. Celent is welcoming submissions for Celent Model Bank 2013 through 30 November 2012. Submissions are made online at http://www.celentmodelbank.com.Comments

-

Thanks for your post Serge.

I'm not aware of any "forcing" going on. Observing branch-based ATM transaction velocities, however, supports strong consumer demand. I fully support your notion of offering complimentary remote channel self-service capabilities. The wildly popular mobile RDC is a great example. It's not either/or. In addition, there simply isn't a solution for cash-related transactions beyond remote ATMs. And, as you know, cash usage remains strong despite the bevy of electronic alternatives.

-

India is an example where both personal and business banking customers will walk into a branch to deposit his cheques into a branch cheque deposit box only because branch boxes provide same day clearing. Similarly, we have a number of banks that provide a bulk cash deposit facility where customers walk into a branch and use a large cover that can be sealed to deposit their cash. The bulk deposit is opened at fixed times and cash counted in the presence of cctv cameras. These are just examples that are working and what it tells me is that banks need to innovate to provide the right type of self service options that make it attractive to their customers.

Does anyone else find it absurd that Banks and Credit Unions would force customers to travel to their Branches just for self-service? Why not enhance self-service experience via remote channels (aka online and mobile) and in the process save the Bank or Credit Union $1MM+ per location?