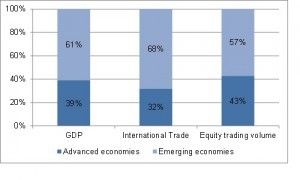

Over-the-counter (OTC) derivatives have come under scrutiny since the Global Financial Crisis (GFC) of 2008. The global OTC derivative market is primarily dominated by the US and Europe, with Asia accounting for less than 10% of notional outstanding. The Asian financial market, unlike its western counterparts, is not a homogeneous entity. Rather, the countries in the region are divided along jurisdictional lines with limited regional integration. Thus Asia not only consists of a large number of countries with each at different level of economic development, they also have different regulatory and monetary regimes. This has resulted in a number of highly localized markets with the exception of a few, notably Hong Kong and Singapore. In two new reports Celent discusses the development in the OTC markets in 11 Asian countries, divided into two groups. The first report looks at the advanced economies and includes Australia, Hong Kong, Japan, New Zealand, and Singapore. The second report covers the emerging economies of China, India, Indonesia, Malaysia, South Korea and Taiwan. It is interesting to note that the emerging countries account for only 9% of total OTC turnover in these countries, even though there share is much higher on other economic and financial indicators.