The dynamics of the US spot FX market

1 August 2012

Sreekrishna Sankar

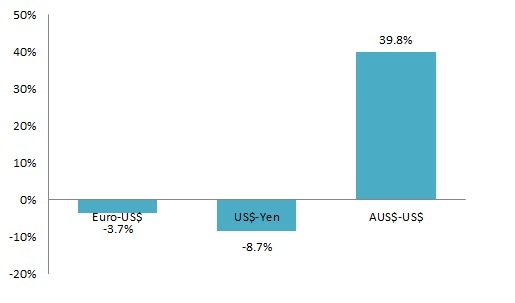

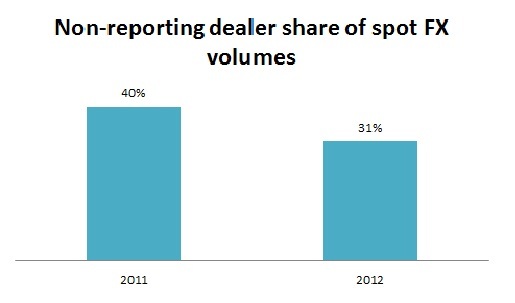

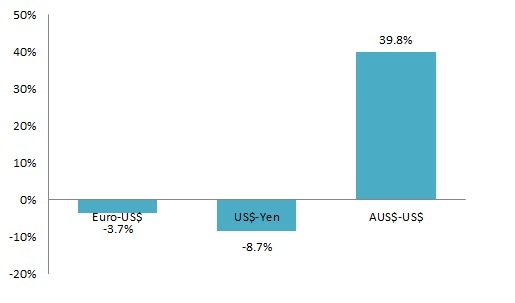

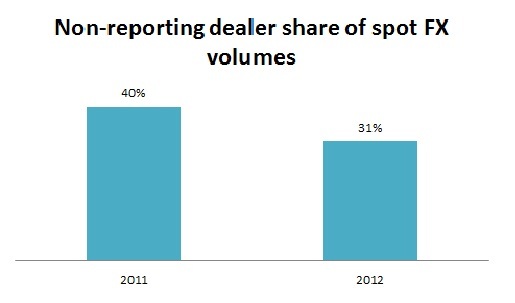

The 2012 mid-year assessment of FX volumes was published last week by the FX committees of all the key FX geographies. An assessment of the FX volume results from US shows us that after the peaking of volumes in September 2011, the volumes have plateaued. FX volumes have grown in US by a meager 0.5% and this has been primarily driven by a fall in spot FX volumes. The core issue is the economic problem and the Euro crisis. The spot FX market fell by 2.4% driven by a fall of Euro-US$ spot volumes by 3.7% and 8.7% volume fall of the US$-yen. The Euro dollar volumes are directly tied to the concerns related to the Euro crisis and the regional and smaller banks have reduced their spot trading in this currency pair. The growing currency pair is the Australian dollar-US$ as it grew by nearly 40% in volumes.  The non-reporting dealer’s volume fall is the reason for the fall in the spot market. The volumes fell by 27%. This segment, which contributed 40% of the spot volumes, is now down to 31% of the volumes. There has been further growth in the financial customer segment, which includes the typical buyside players with the volumes going up by 14%. Now this segment contributes 40% of the spot FX volumes. This suggests that the business model of the platforms should be tuned to cater to this market, by providing better algorithm tools and risk management offerings.

The non-reporting dealer’s volume fall is the reason for the fall in the spot market. The volumes fell by 27%. This segment, which contributed 40% of the spot volumes, is now down to 31% of the volumes. There has been further growth in the financial customer segment, which includes the typical buyside players with the volumes going up by 14%. Now this segment contributes 40% of the spot FX volumes. This suggests that the business model of the platforms should be tuned to cater to this market, by providing better algorithm tools and risk management offerings.  The growth in the financial customer segment volumes reflects in the execution methods as well. The electronic trading system share of the spot FX volumes has grown to 37% from the 25% market share in April 2011.

The growth in the financial customer segment volumes reflects in the execution methods as well. The electronic trading system share of the spot FX volumes has grown to 37% from the 25% market share in April 2011.

The non-reporting dealer’s volume fall is the reason for the fall in the spot market. The volumes fell by 27%. This segment, which contributed 40% of the spot volumes, is now down to 31% of the volumes. There has been further growth in the financial customer segment, which includes the typical buyside players with the volumes going up by 14%. Now this segment contributes 40% of the spot FX volumes. This suggests that the business model of the platforms should be tuned to cater to this market, by providing better algorithm tools and risk management offerings.

The non-reporting dealer’s volume fall is the reason for the fall in the spot market. The volumes fell by 27%. This segment, which contributed 40% of the spot volumes, is now down to 31% of the volumes. There has been further growth in the financial customer segment, which includes the typical buyside players with the volumes going up by 14%. Now this segment contributes 40% of the spot FX volumes. This suggests that the business model of the platforms should be tuned to cater to this market, by providing better algorithm tools and risk management offerings.  The growth in the financial customer segment volumes reflects in the execution methods as well. The electronic trading system share of the spot FX volumes has grown to 37% from the 25% market share in April 2011.

The growth in the financial customer segment volumes reflects in the execution methods as well. The electronic trading system share of the spot FX volumes has grown to 37% from the 25% market share in April 2011.