Data to Actively Manage ESG Investing

9 July 2018

Kelley Byrnes

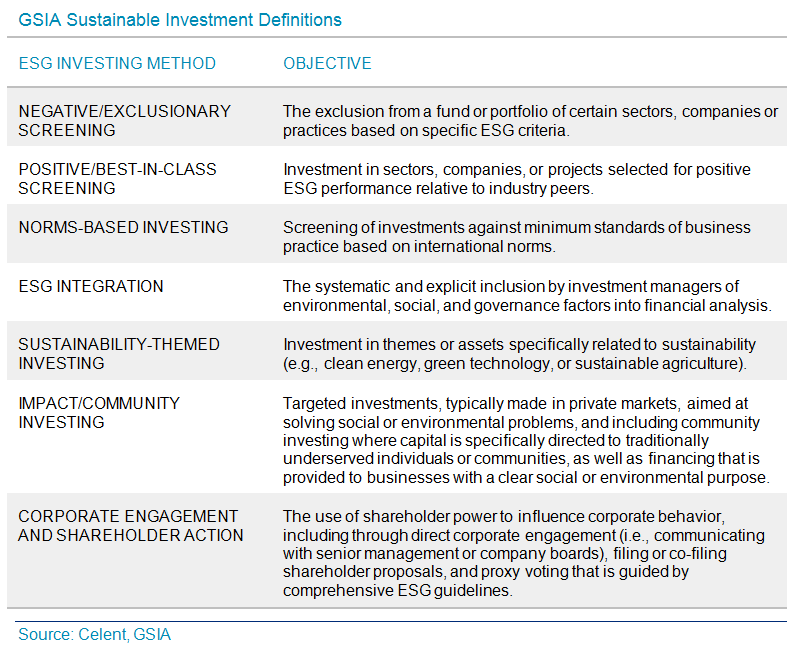

This report builds upon the Celent report Impact Investing Reporting and Analysis Technology: Greenfield, February 2018, with a focus on the data and ranking systems available to actively manage environmental social governance (ESG) investing.

Key research questions

- What are the different methods of actively managing ESG investing?

- What data sets and tools exists for ESG investing?

- How are data and technology used to measure ESG portfolio performance?

Abstract

This report looks to 1) shed light on the methodology behind popular ESG scores and ranking systems and 2) introduce a specialist low-carbon data content provider, so that asset owners can feel confident relying on the data provided by content providers and specialist research providers.