Is the ACH the Best Path to Faster Payments?

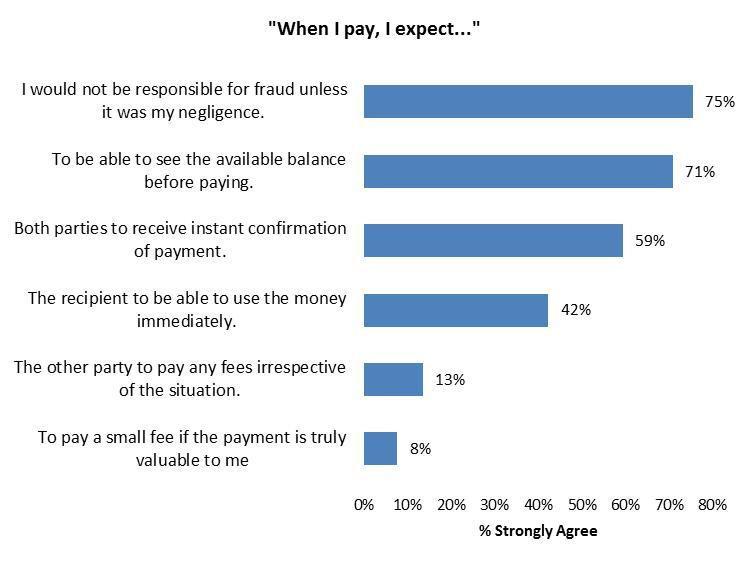

Source: Celent survey of US consumers, July 2013, n=1,053 In my view, merchants and regulators are more invested in faster payments than are consumers. Faster payments mean earlier access to funds (retailers) and less systemic risk (regulators). That’s why most systemically important payment systems are RTGS. Faster payments are a certainty – in time. What’s far from certain is how it comes to be – what rails are used. Some advocate using the ACH. I disagree. Moreover, I find the current dissatisfaction with the ACH amusing. Designed as an efficient, electronic, float-neutral payment system, the ACH is highly effective at fulfilling its designed purpose. More recent demands on the ACH, while not without efficacy, have also resulted in increased cost and complexity. Same-day ACH, in my opinion, is simply not compelling. If enacted through a rules change and offered optionally at a premium price, it may succeed, but would result in precious little use. Real-time ACH would be altogether different – a fool’s errand in my opinion. The ACH works splendidly when used as designed. An analogy if I may. The NACHA press release stated: “The Network has always served as a foundation upon which we can build and innovate to meet the growing needs of today’s users and those of tomorrow.” That sounds a bit like inviting telco’s to build more phone booths in response to consumer’s demand for mobility. The “square peg in a round hole” analogy may work as well. I'd love to hear your views.

Source: Celent survey of US consumers, July 2013, n=1,053 In my view, merchants and regulators are more invested in faster payments than are consumers. Faster payments mean earlier access to funds (retailers) and less systemic risk (regulators). That’s why most systemically important payment systems are RTGS. Faster payments are a certainty – in time. What’s far from certain is how it comes to be – what rails are used. Some advocate using the ACH. I disagree. Moreover, I find the current dissatisfaction with the ACH amusing. Designed as an efficient, electronic, float-neutral payment system, the ACH is highly effective at fulfilling its designed purpose. More recent demands on the ACH, while not without efficacy, have also resulted in increased cost and complexity. Same-day ACH, in my opinion, is simply not compelling. If enacted through a rules change and offered optionally at a premium price, it may succeed, but would result in precious little use. Real-time ACH would be altogether different – a fool’s errand in my opinion. The ACH works splendidly when used as designed. An analogy if I may. The NACHA press release stated: “The Network has always served as a foundation upon which we can build and innovate to meet the growing needs of today’s users and those of tomorrow.” That sounds a bit like inviting telco’s to build more phone booths in response to consumer’s demand for mobility. The “square peg in a round hole” analogy may work as well. I'd love to hear your views.Comments

-

An interesting survey response and one which, unless complemented by another suite of questions (perhaps entitled "When I receive payments, I expect") is incomplete. For example turn the 4th question around and it becomes "when I receive money I expect to be able to use it immediately" which would probably incur a higher response rate (especially amongst small businesses), as would an addition to the original list "when I make a payment I expect my obligations to be cleared immediately" (a very popular guarantee with UK citizens paying their monthly credit card bill on the final due date in real-time and avoiding interest charges).

The subject of this article seems to focus primarily on the Person to Business Use Case (typically a card payment) which is primarily asymmetrical – but this is only one use case. ACH payments are about peer to peer, symmetrical payments. As such they are a vital underpinning to payments across all use cases except that of systemically significant payments, where transfers across the books of the relevant central bank are the appropriate form. The ACH should at its core be capable of supporting the highest service level that may be required of it- immediate payment on a continuous clearing model (note not RTGS). Certainly, where required to meet legacy demands it can then be "de-tuned" to emulate a legacy batch transfer and settlement process. Unfortunately this doesn't work the other way. Speeding up batched payments, whilst commendable from many angles, simply does not have the transformative punch of a real-time retail service. In this way I agree that the current batch ACH may not be the right rails for the future – but the fundamental role of the ACH, (a general purpose payments infrastructure) re-invented in real-time mode will be the right rails to support the raft of future, faster payments needs. -

[…] what ‘real-time’ really means and what is the best way to achieve it, as indicated by Bob Meara’s blog about the same-day ACH initiative. At the conference the Fed representatives shared the results of the public consultation on […]

-

[…] recently posted some views on the same day ACH – as always, great points, well made. Somehow, in Twittersphere, some of the comments got […]

-

I agree, Eric! For some companies, however, moving to ACH on the receivables side, unless accompanied by EBPP creates more cost on the cash application side than is saved (by the payor), so they persist wanting to be paid by check. Change here, unfortunately, is slow.

-

Thanks for weighing in, Nick! I agree with you about the survey - one data point is not conclusive. We're clearly behind the UK here and perhaps consumer attitudes remain forgiving (for now).

I think the current system is fine, however, more companies should adopt the ACH as a payment method. It is less expensive, and returns are received faster. Seems like a no-brainer to me!