I recently published the Celent report “Electronic Signatures in South Korean Insurance: Enabling Paperless Policies”. Actually, at first I intended to write a report about e-business in the South Korean insurance industry. (I will get to that topic next year …) However, I found that South Korean insurers sell more than 80% of their products through sales agents. Furthermore, I found that there is a new trend for sales agents: the adoption of e-signatures for policies.

Adoption of e-signatures has significantly changed the work flow for insurance sales agents in South Korea. With a paper-based insurance contract, a sales agent must visit the home or other location of the policyholder at least twice; however, with an electronic contract, the sales agent only has to visit the individual once to complete the transaction process—from explanation to signing the contract.

Another merit of this so-called “smart insurance” is that it eliminates the need for the sales agent to input customer data after returning to the office because after being e-signed the contract is sent directly to the server. Smart insurance also obviates the risk of losing a signed paper contract before inputting the data—a risk that has until now been a part of doing business on paper.

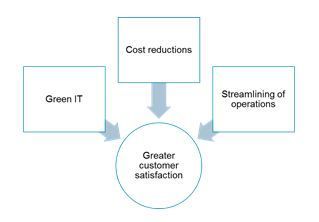

To determine exactly what benefits the industry expects of e-signatures, Celent conducted a survey of insurers in South Korea. The salient points articulated by interviewees are listed below.

• Streamlining and heightened efficiency throughout the contract process. • Reducing costs such as paper and storage expenses. • Enhanced customer satisfaction. • Realizing green IT.

I will write a report on direct insurance channel including e-business in South Korea in early 2013. Don’t miss it!