Last week, Wells Fargo promoted new banking by appointment via outbound e-mail marketing. I say it’s about time! Here's how it appeared:  Online appointment booking is just plain smart. It’s also overdue. For years, consumers have been able to schedule appointments with healthcare providers, hair dressers and restaurants – why not banks? The idea makes sense for several reasons: • It provides an easy call-to-action as part of marketing communications. • It helps banks balance staff capacity with sales and service demand. • It allows front line staff to be prepared for customer meetings, rather than reacting on the spot as customers approach. • It is clearly preferred by some consumers and minimizes wait times. Celent surveyed US and Canadian consumers on two occasions in 2013 and found them highly digitally-driven – except when they had something substantive to discuss. Then, they preferred face-to-face interaction.

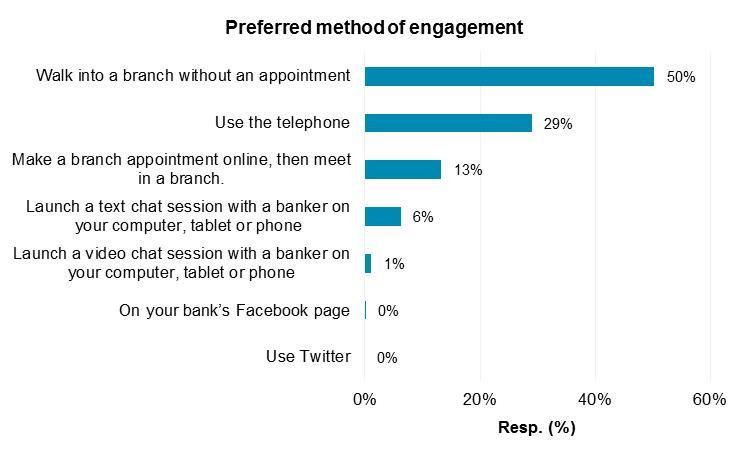

Online appointment booking is just plain smart. It’s also overdue. For years, consumers have been able to schedule appointments with healthcare providers, hair dressers and restaurants – why not banks? The idea makes sense for several reasons: • It provides an easy call-to-action as part of marketing communications. • It helps banks balance staff capacity with sales and service demand. • It allows front line staff to be prepared for customer meetings, rather than reacting on the spot as customers approach. • It is clearly preferred by some consumers and minimizes wait times. Celent surveyed US and Canadian consumers on two occasions in 2013 and found them highly digitally-driven – except when they had something substantive to discuss. Then, they preferred face-to-face interaction.  Source: Celent US consumer survey, June 2013, n=1,033 Q: "If you had an important topic you would like to discuss with a banker, how would you prefer to do so?" In my opinion, effective online appointment booking capabilities would be: • Omnichannel – offered in multiple channels for engagement via multiple channels, not just the branch • Integrated to existing calendaring applications to be low-friction for both consumers and staff • Set up to automatically remind consumers of their appointment and easily revisited in case a change was needed. This should minimize no-shows. • Tracked – rigorous measurement of appointment booking and subsequent results is key to continual improvement. I’m wondering why this functionality remains a rarity among retail banks.

Source: Celent US consumer survey, June 2013, n=1,033 Q: "If you had an important topic you would like to discuss with a banker, how would you prefer to do so?" In my opinion, effective online appointment booking capabilities would be: • Omnichannel – offered in multiple channels for engagement via multiple channels, not just the branch • Integrated to existing calendaring applications to be low-friction for both consumers and staff • Set up to automatically remind consumers of their appointment and easily revisited in case a change was needed. This should minimize no-shows. • Tracked – rigorous measurement of appointment booking and subsequent results is key to continual improvement. I’m wondering why this functionality remains a rarity among retail banks.