What does “Digital” mean in banking?

30 December 2014

Dan Latimore

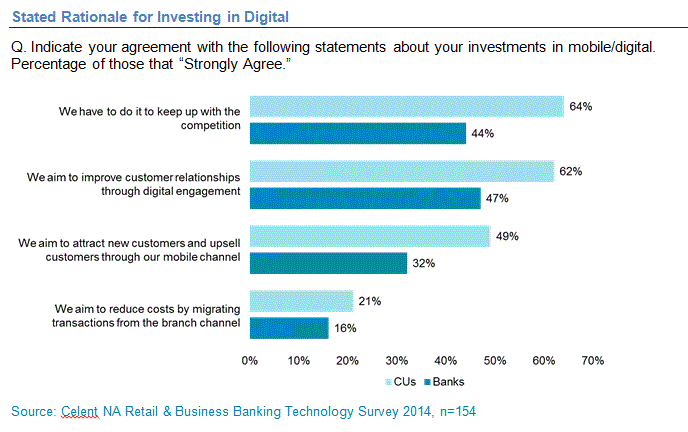

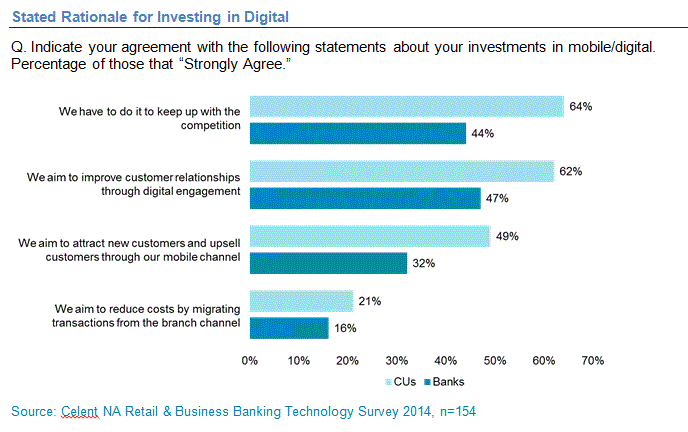

Everyone in banking is talking about “Digital.” Celent has hosted fascinating roundtables on the topic, and it’s the basis of one of our three themes. And yet, there’s a startling lack of consensus on what Digital means. There’s a famous proverb of a group of people in a dark room who touch different parts of an elephant; each describes a completely different experience. Digital is like that: how you experience it depends on where you’re coming from. To help bring perspective to the Digital debate, Celent has put its own stake in the ground with a new report, Defining a Digital Financial Institution: What “Digital” Means in Banking. We describe a framework that helps financial institutions make sure that they’re addressing all the possibilities of digital comprehensively, from the mundane to the sophisticated, from customer-facing channels to the back office. Rationales for digital investment vary widely, as the graphic below demonstrates. All have validity; banks have to decide how digital aligns with their specific strategic goals.  There must ultimately be an economic rationale for digital investments. Celent clients can download the report for more information.

There must ultimately be an economic rationale for digital investments. Celent clients can download the report for more information.

There must ultimately be an economic rationale for digital investments. Celent clients can download the report for more information.

There must ultimately be an economic rationale for digital investments. Celent clients can download the report for more information.