Over the past decade, institutional investors’ quest for higher returns and portfolio diversification in an era of low interest rates and favorable credit conditions fueled the growth of private markets and alternative investments. However, recent challenges such as quantitative tightening, asset price dislocations, and disruptions in the economic supply chain due to sociopolitical dynamics have created headwinds and a loss of momentum for private markets investments.

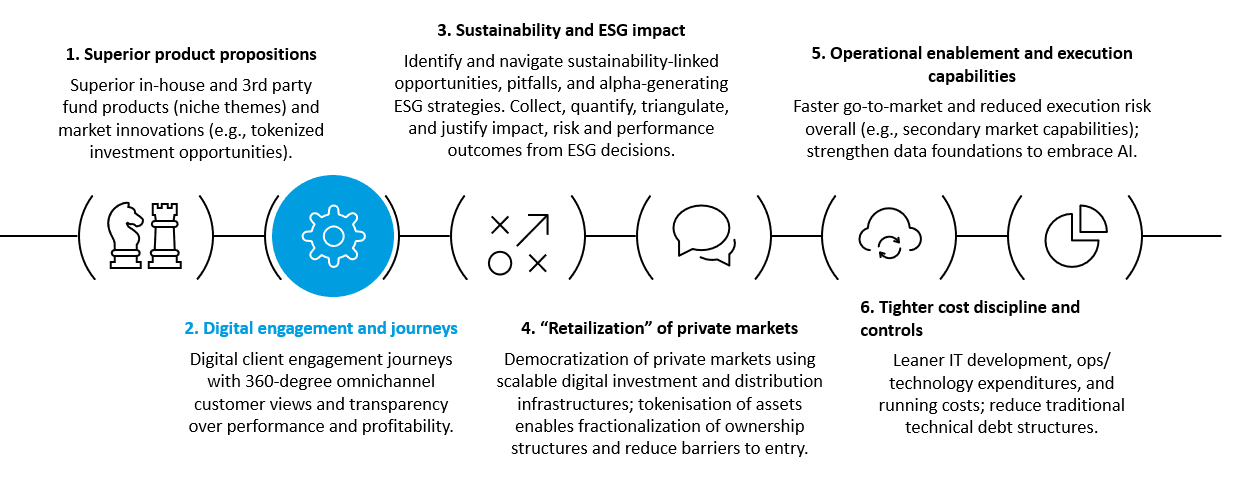

The financial industry is currently experiencing a significant inflection point, shaped by a confluence of macroeconomic forces, geopolitical repercussions, and renewed capital requirements in a post-pandemic environment. Stormy conditions aside, other future-oriented vectors are accelerating the ongoing transition to the sustainability/ESG agenda, digital assets, and the continued digitization of markets.

With ongoing technology advancements, there are opportunities to employ advanced data analytics/AI, blockchain, and digital propositions to identify investment opportunities, improve transparency, democratize markets, and drive efficient collaboration throughout the investment value chain.

To meet these aspirations, companies must upgrade their strategic data capabilities to remain viable in the digital age, while regulatory operations must become more efficient, predictable, and error-free. The ability to face off against market demands, adapt and respond to business imperatives, and capitalize on emerging opportunities is inevitably intertwined with core operational and technology capabilities.

In this solution brief, we focus on Pepper, a FinTech firm that offers a cloud-native investment data platform for Alternative Asset Managers and Allocators. Celent provides an independent opinion on Pepper's approach, its potential for scaled expansions, and opportunities for continued impact on the financial industry through innovative methods and technologies.

----------

For more in-depth research around future buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.