What’s App, Doc? A Review of Mobile Bank Apps in Latin America

Abstract

Celent has released a new report titled What’s App Doc? A Review of Mobile Bank Apps in Latin America. The report was written by Luis Chipana, an Analyst with Celent’s Banking practice.

In a world where banks are becoming more and more digital, it is difficult to think of a single bank that does not have an app, even in Latin America. Today apps are spread worldwide in the financial services industry, yet their functions differ from country to country and bank to bank.

This report analyzes 158 apps of 50 banks across 10 countries in Latin America and provides insights into their main features and trends.

Ninety percent of banks in Latin America offer apps. The leaders for banking apps are Android and Apple’s iOS, with 36% and 35% market share respectively, followed by BlackBerry with 18% and Windows with 11%. Sixty-six percent of the banks in the region offer apps to their clients in at least three platforms.

Essentially, apps in Latin America allow clients to access their accounts to check balance, perform transactions like payments, office location services, and assistance. However, few banks offer loan and other account application forms through the app.

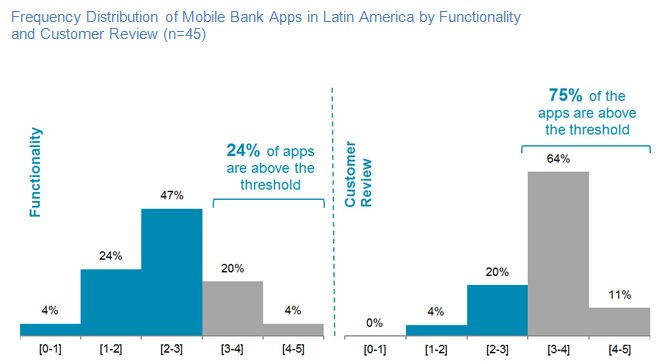

In terms of functionality, 24% of the apps score 3 or higher on a 1 to 5 scale, which is the threshold in which customers are neither content nor discontent with them. Regarding customer reviews, 75% of the apps score above 3.

“For banks, smartphones represent an important component of a digital strategy where the client is at the center,” commented Chipana.

“The use of apps in smartphones helps banks expand their services through a low-cost channel. Transactions from traditional channels like call centers or branches will eventually migrate to these lower-cost channels, where most of the transactions are performed by self-servicing capabilities,” he added.