E-Signature in South Korea's Insurance Industry

10 October 2012

KyongSun Kong

South Korea’s insurance industry experienced a significant change at the beginning of 2012: regulators made it possible for insurers to accept e-signatures as legally binding on policies. In South Korea, most sales are through the agent channel. E-signatures are expected to change their work style, in that they can now process policies for customers in a more efficient way.

We expect e-signatures will become an important “channel” in insurance distribution. It is an attractive point for both customers and sales agents that the sales cycle can be completed in the filed with “one-stop.” Utilizing tablet computers, sales agents can now complete the entire sales process, including binding, in the field, without needing to return to the office to print out quotes or policies.

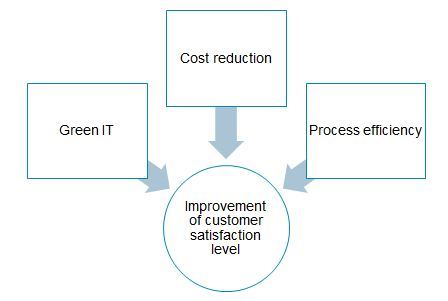

E-signatures will impact Korean insurers in the following ways: • Process efficiency for policies • Cost reduction for paper and storage • Green IT • Improvement of customer satisfaction level

Insurers will be able to achieve some of the expected benefits in the short-term, but others might take a long time to produce results. Insurers therefore should consider the e-signature as a long-term initiative and not focus too much on short-term ROI. For more details, you can read our upcoming report, which will be published in Japanese shortly and in English in November.