Corporate banking is at a critical juncture of accelerated change.

External factors are driving disruptions and opportunities in corporate banking. Banks are at risk of falling behind in their response. Players in the corporate banking arena need to assure that they keep pace and take significant strides to compete effectively with financial institutions at the vanguard of technology as well as digital giants and fintech firms. Companies need to cease product-centric approaches and embrace a customer-centric approach, one that reimagines and improves the customer “journey.” Banks need to digitize paper-based processes and put top priority on shifting from intuition-driven decision-making to data and analysis-driven decision-making.

This report is the fifth installment in the series on the ongoing digital transformation in Japan’s banking industry. It focuses on transaction banking and critical trends that Japanese banks should take into consideration when they formulate their strategic plans and technological road map. Celent chose to focus on three areas based on their importance to banks’ ability to face disruption and seize opportunities:

Set the stage: Understanding of factors driving growth in transaction banking and implications for Japanese banks.

Key opportunity one: Excelling in serving small and medium-sized enterprise (SME).

Key opportunity two: Becoming the next generation bank.

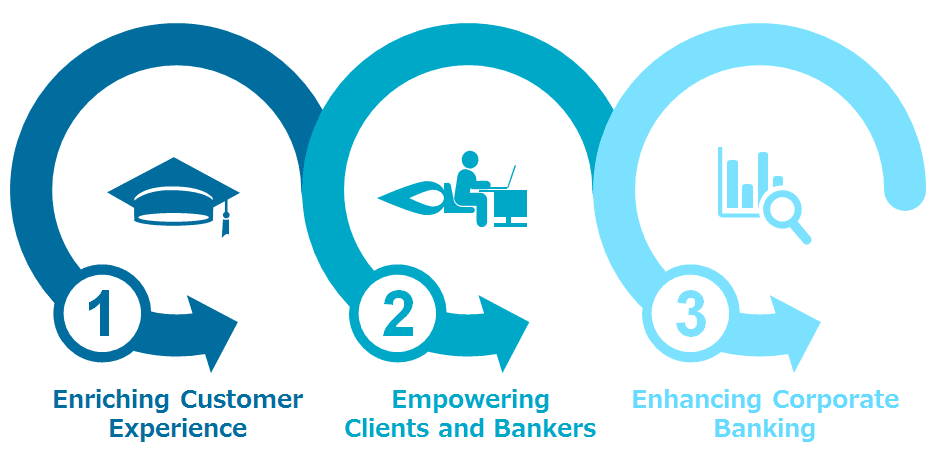

Banks will need to work to maintain the existing transaction banking global revenue pool that is estimated at US$290 billion by Oliver Wyman of which APAC accounts for $109 BN (estimate of the total based on payment and cash management services, trade finance, 2017). To capture a greater share of this pool and make inroads into new markets, bank executives and business line owners need to work closely with CFO (chief financial officer) office and relationship managers, operations and customer support teams, technology teams… to enrich the customer experience. Areas urgently requiring attention include providing bank staff with data analysis tools, adopting agile delivery models, and use self-service solutions to improve collaborative efforts with clients. In addition, it will also prove important to adopt a design-oriented approach and partner with cutting-edge solution providers to strengthen the overall corporate banking organizational structure.

Steps to Reaching the NextLevel of Corporate Banking