Abstract

Celent estimates that financial industry spending on AML-KYC compliance information technology (IT) and operations will reach US$37.1 billion globally in 2021. AML-KYC IT spending is estimated to grow at 13.4% in 2021 compared to 2020; IT spending has absorbed the brunt of COVID-19’s impact and is on its way to regaining its long-term average growth rate.

Immediately after the onset of the pandemic, many banks reprioritized fraud operations in 2020 due to higher risks of fraud while AML took a backseat. With the financial system having stabilized and adapting to a new normal, banks and regulators are refocusing their scrutiny in AML and renewing efforts and investments. Digital onboarding has emerged as one of the top priorities in the last 18 months with banks needing to support remote onboarding, video KYC, and similar capabilities. This is forcing system enhancements and, in many cases, new initiatives to develop new tools.

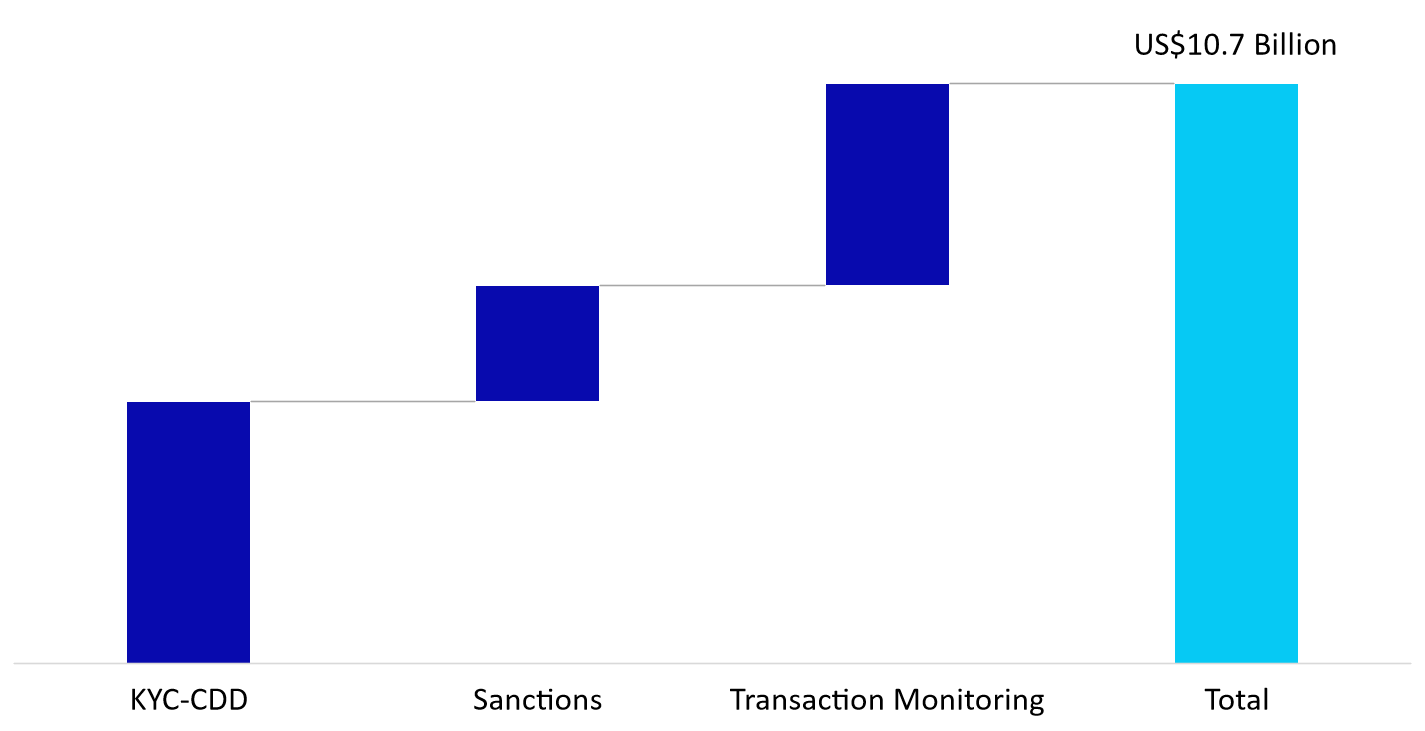

Celent estimates that IT spending in AML-KYC compliance to reach US$10.7 billion and spending on operations to reach US$26.4 billion globally in 2021.

AML-KYC IT Spending (2021)

Source: Celent

Despite banks’ continued dominance in AML IT spending, expanding regulatory scrutiny on non-bank segments is raising their share in the spending pie. Especially in KYC and screening, digitally focused firms such as retail brokers and wealth management firms as well as new financial services entrants such as crypto providers are implementing new solutions and processes. Some of the largest bank holding companies are transforming their AML controls in non-bank business lines (e.g., insurance).

For the most part of the 2010’s, banks responded to growing regulatory scrutiny by building armies of AML investigators. This trend has plateaued as new technology is enabling more automation and reducing the need for manual work. Celent expects continued interest in next generation technologies such as artificial intelligence (AI), natural language processing (NLP), cloud, new encryption techniques, and growing adoption of regtech solutions powered by these new technologies, both to reduce manual time spent on less productive activities as well as deliver superior insights and compliance.

This report provides Celent’s estimates of spending on AML-KYC technology and operations by financial institutions worldwide, including banks, insurance companies, broker-dealers, and wealth and asset management firms. The report presents global estimates as well as detailed breakdowns of:

- Spending by global region: North America, Europe, Asia, and the rest of the world.

- Functional distribution of spending with focus on three key AML-KYC components: KYC-CDD, sanctions screening, and transaction monitoring.

- Technology spending breakdown by: internal spending, hardware, external software, and external services.

- Operational spending trends (in addition to technology spending).

- Spending according to the type and size of financial institution.

- Spending on new initiatives vs. run-the-bank maintenance activities.

- Key technology trends and imperatives for financial institutions and solution providers in 2022.