Property Casualty Insurance Research Outlook 2024

EXECUTIVE SUMMARY

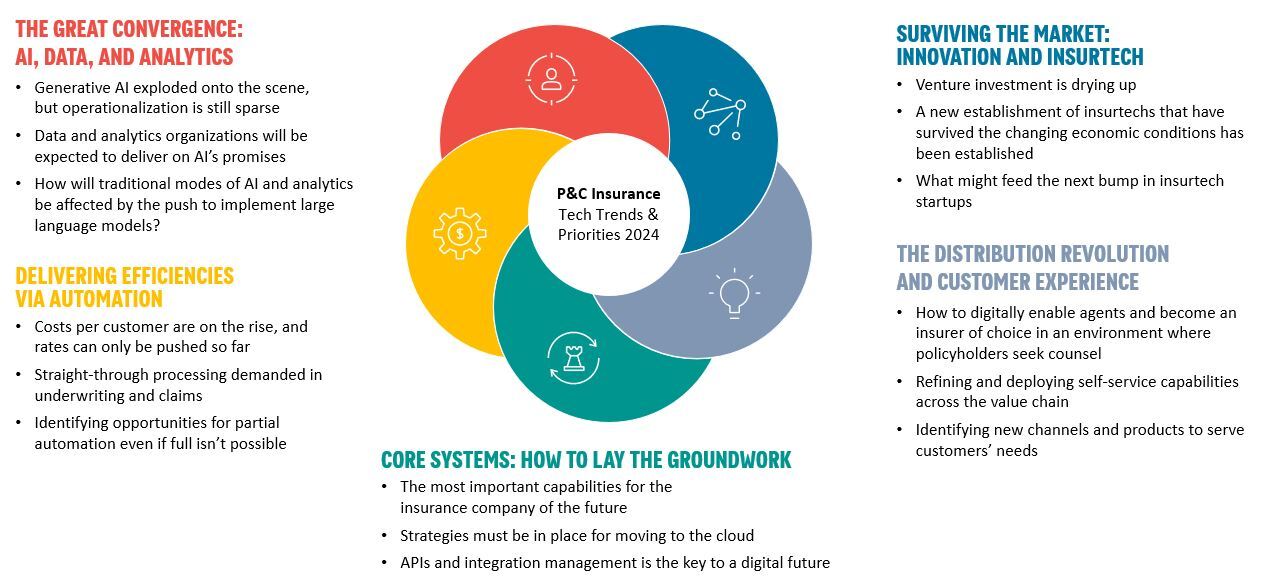

The insurance industry continues to be engaged in a profound transformation driven by advancements in technology and challenging risks posed to individuals, enteprises, and society as a whole. As we get ready to close out 2024 the key topics identified by Celent for this year continue to resonate and direct the attention of insurers.

The exponential growth of data and the advent of artificial intelligence (AI) have revolutionized the insurance industry. Insurers now have access to vast amounts of data, enabling them to gain deeper insights into customer behavior, risk assessment, and claims management.

The traditional insurance distribution model is being disrupted by digital technologies which enable higher levels of automation for existing channels, along with new distributions models and partnerships. Insurtech startups and digital platforms are reshaping the way insurance products are marketed, sold, and serviced.

Smart Automation, such as the one enabled by robotic process automation (RPA) and cognitive computing, are transforming insurance operations by streamlining processes, reducing costs, and improving efficiency. There is a hge potential of smart automation in insurance, including the automation of underwriting, claims processing, policy administration, and customer service.

Insurtech startups are pushing the boundaries of innovation in the insurance industry and challenging the incumbents to keep the pace. Emerging Technologies are also reshaping the insurance landscape in areas such as risk assessment, claims management, fraud detection, and customer experience. Implementing and integrating these technologies into insurers' core systems, is no exempt of challenges, such as legacy system modernization, data interoperability, and cybersecurity considerations.

The efficient functioning of insurers' core systems is vital for their day-to-day operations. Keeping up to date on what’s important in core and non-core insurance systems is a must for insurers to avoid piling up technical debt. Modern systems are incorporating AI, new and better use of data, and increased levels of automation and integration, to better support the business and build ecosystems that provide value to their clients and partners.

The areas of research that we’re working on for this quarter are critical areas that we suggest insurers consider to optimize the value of their technology investments.

Contact us for more information about what we have planned in Q4.

If you are a client, please sign in to access a detailed view of our 2024 agenda.