Retail Banking Research Outlook 2024

TAKING AGILITY TO THE NEXT LEVEL: OUR 2024 RESEARCH THEMES

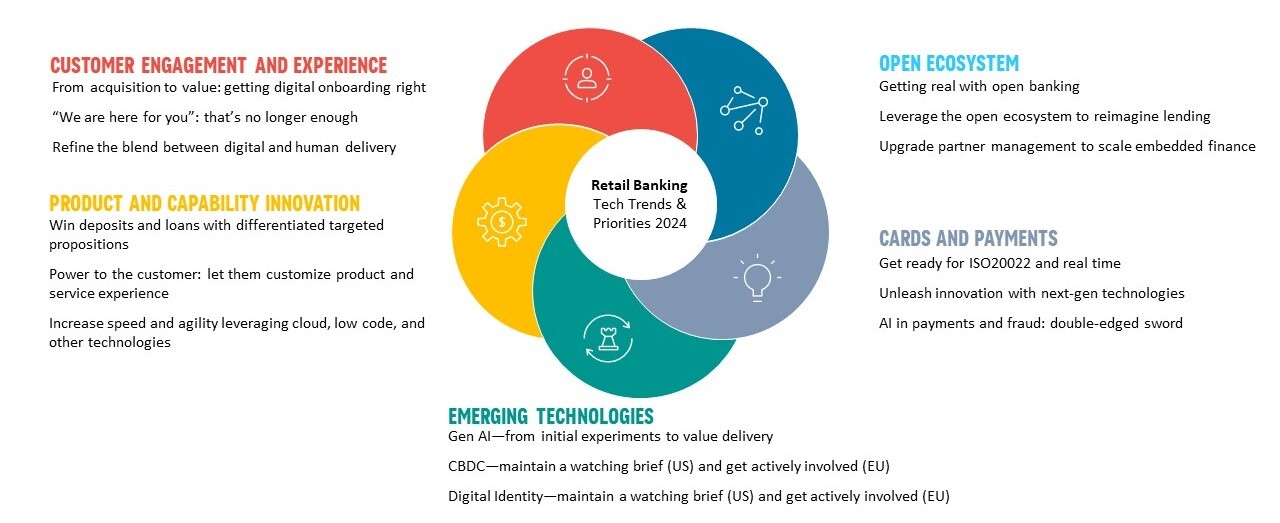

57% of banks say that “greater speed and agility” is one of the top three drivers of their technology strategy. Banks have long sought agility through technology investments, from automating record-keeping and internal workflows to increasingly digital-first customer engagement. In 2024, retail banks are mastering a growing array of tools to take organizational agility to the next level – from low code platforms to cloud to generative AI—while doubling-down on five major themes outlined in the figure below and carefully picking the areas of focus.

These five themes also guide our research agenda for 2024. Of course, at this level the themes are not that different from last year, other than perhaps a more explicit focus on emerging technologies. And there is already plenty in the library, as we have been producing research focused on these topics, for both retail and corporate banking clients.

In Q1 we announced the winners of our Model Bank awards, the program we launched 17 years ago to recognize financial institutions for best practices of technology usage in different areas critical to success in banking. This year, we recognized 19 financial institutions with Model Bank 2024 awards, and published detailed case studies available to our research clients.

In these challenging times one thing is certain: none of us can go it alone. As you face hard decisions in the areas of technology and partnerships, Celent is here to support you. We can help you vet partners and technologies as you respond to competitive and government initiatives, the changing needs of your customers, and growing cost pressures.

As always, we’ll look to be nimble and respond to fast-moving developments in our research space. So, if you have a hot topic in mind, where our research could add value to your organization, please get in touch, and we’ll endeavor to incorporate it into our research agenda for the remainder of 2024.

Contact us for more information about what we have planned in Q4.

If you are a client, please sign in to access a full view of our 2024 agenda.