金融サービスにおけるデジタル接続の活用が加速するなか、不正防止テクノロジーは顧客の口座と取引の安全確保を目的とするソリューションの複雑なエコシステムへと発展を遂げている。同時に、大口取引モデル(LTM)など生成AIを使った技術を含む高度なAI機能を使うことで、金融機関は増え続ける新しい詐欺の仕組みや詐欺グループの技術の巧妙化に立ち向かうための新たなツールを手に入れることができる。セレントの推計では、こうした機能をサポートする必要性から不正防止関連のIT投資は年率6.9%のペースで拡大し、2028年には総額213億ドルに達するとみられる。

本レポートでは、2023年に実施したCelent Technology Insight and Strategy Survey (CTISS) で得られたデータをもとに、世界の金融機関(銀行、保険会社、証券会社、ウェルス/アセットマネジメント会社など)が不正防止テクノロジーと関連業務に振り向ける投資額を推定している。その中では、世界全体の投資額とその内訳を以下のカテゴリーごとに示している。

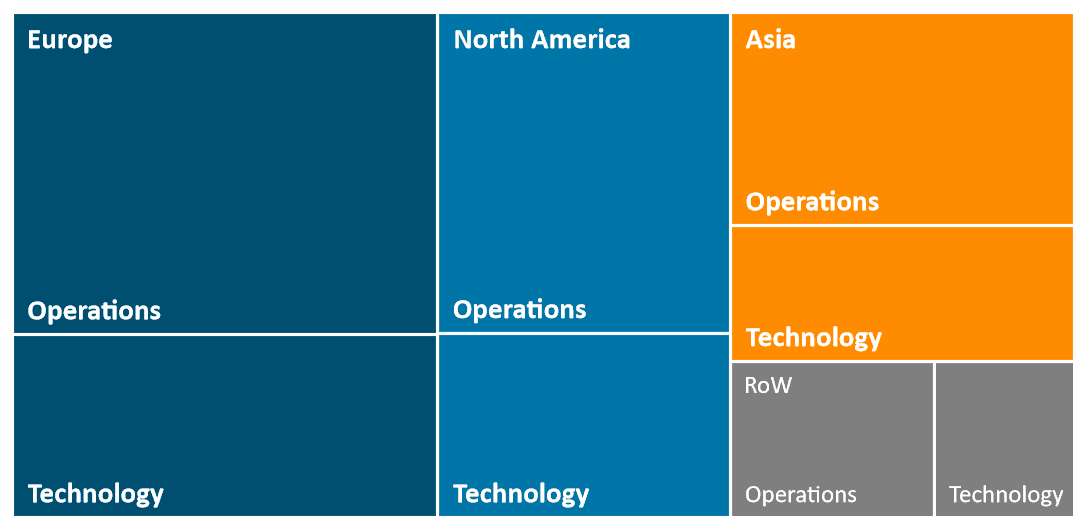

- 世界の地域別投資額:北米、欧州、アジアとその他の地域

- システムのカテゴリー別投資額:社外ソフトウェア、社外サービス、社内投資および社内ハードウェア/インフラ

- 業務への投資のトレンド

- 金融機関の種類と規模別投資額

- 新規プロジェクトと保守・管理業務への投資額の比較

- 2024年に金融機関とソリューションプロバイダーが直面する主なテクノロジートレンドと緊急課題