オペレーショナル・レジリエンス規制に向けた動きを受け、金融機関ではGRC (ガバナンス・リスク・コンプライアンス) トランスフォーメーションが加速しており、特に、規制要件が厳格で、遵守期限が迫っている国では対応が急務となっている。オペレーショナル・レジリエンスは、チーフ・リスク・オフィサー (CRO) にとって2023年の3大優先事項の1つであり、銀行のCROの74%がこれに準拠するために必要な変更に取り組んでいる最中である。

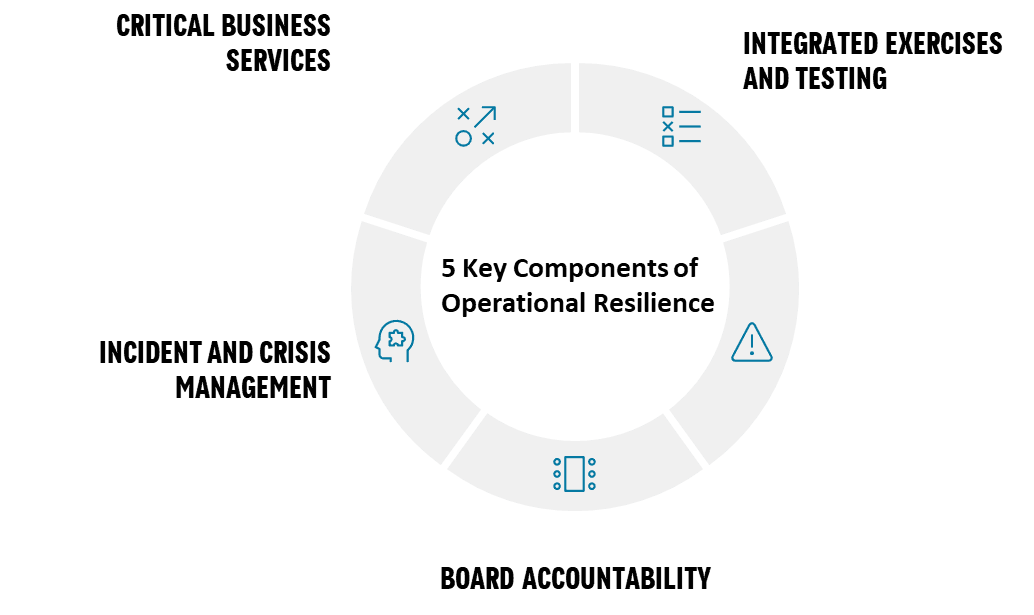

金融機関に求められるオペレーショナル・レジリエンス規制では共通する5つの要素があり、そのうち3つの要素は、a. エンタープライズリスクを包括的に把握する、b. 事業部門および地域のサイロ全体でリスクを評価する、c. 新たな脅威に迅速かつ一元的に対応する能力を構築するということである。オペレーショナル・レジリエンスという概念が示されたことで、金融機関 (特に銀行) は、これまで非現実的とされていた「エンタープライズリスク管理 (ERM) への統合されたアプローチ」を目指している。セレントが調査した金融機関の85%は、既存のシステムではオペレーショナルリスクを一元的に管理できないと回答しているが、一元管理はレジリエンスの構築に不可欠な機能である。そのため、この規制を受けて各金融機関はERMの成熟度の向上に取り組んでいる。

本レポートの調査結果は、2023年5月に205名のリスクエグゼクティブを対象に行ったグローバル調査に加え、20名以上の金融サービス企業幹部や業界関係者への1対1のインタビューに基づいている。本レポートの内容は以下のとおり。

- 現行および懸案中のオペレーショナル・レジリエンス (OR) 規制

- すべてのOR規制に共通する5つの重要な要素

- ORがCROの優先事項に与える影響

- 統合リスク管理の成熟度モデルと同モデルにおける金融機関の分布

- GRC機能を強化する主要なテクノロジー

- GRCトランスフォーメーションへの4つのアプローチ

オペレーショナル・レジリエンスの5つの重要な要素