Banks need to jump onto the PFM bandwagon

コメント

-

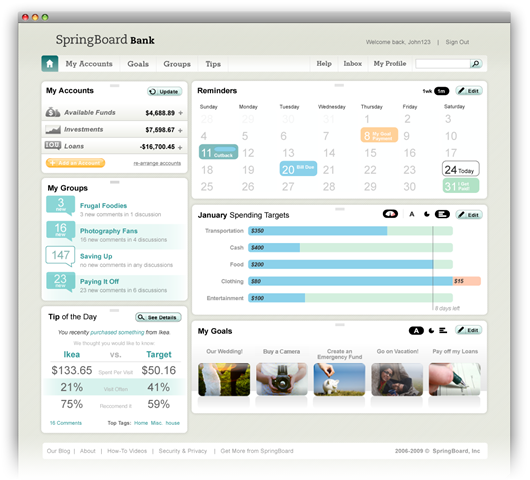

In today's economy, consumers and businesses are looking for help managing their finances through a trusted partner- - their financial institution. It's clear banks and credit unions are seeing the opportunity, too.

-

Jacob ... would love your take on how banks and credit unions would "justify" the expense of incorporating PFM into their mix of online services. I agree with Tobin's remark on "trusted partner", but many FIs feel they need to calculate an ROI on everything. If you are Wesabi, what is your selling point to how FIs offer this to their clients?

-

@Chris Fleischer

Thanks for your comment Chris. There is no doubt that the ROI factors in, particularly today when bank IT budgets are so tight. There are a few ways to look at this:

- Lower attrition rates. Increased adoption of PFM is yet another tie that binds customers to the bank. Customers spend time working on their PFM setup (tagging, categorizing, etc.) and it's not a simple step to start that from scratch at another bank or provider.

- Potential for cross-selling other services. Although banks have not done a great job cross-selling online (generally speaking), a bank could use PFM as an entry point to offer other services (e.g. a credit card or loan) as they learn more about where the customer spends/earns.Finally, although difficult to factor into an ROI, these types of PFM solutions could be significant competitive differentiators. This is an area where banks have generally done a poor job - adoption of these next gen tools is a way to stand above the competition.

-

Having personally worked in both big banking and credit union corporate offices in senior positions I can attest to the frustration of building customer centric tools and statements. The big banks are structured around distribution, product and segment and even within silos they can not seem to agree on priorities (largely due to executive pay structures). In the credit unions they tend to be too small to develop solutions in house and underestimate the value of their online presence. Luckily, as credit unions are building scale and creating infrastructure able to see beyond third party management I predict they will be the first to springboard their online functionality before the banks catch on.

-

Jacob- What I’ve found interesting during this time of growing interest in 3rd party PFMs is the number actual bank customers using their bank’s online portal. A recent Gallup survey found that 46% of bank customers NEVER bank online. This is nowhere close to the kind of penetration banks are looking for from their online portals. In my opinion, PFMs need to be viewed as a way to attract customers to a Bank’s website to increase cross selling, the number of online transactions, and the stickiness of a bank’s online portal.

It is clear non-bank PFMs are becoming increasingly popular amongst the online banking crowd. In this cash-strapped operating environment, will banks decide to buy, build, or acquire? I think the interest in Wesabe's offering indicates there is some momentum on the “buy” side.

-

Mohit, you highlight some important factors. It should come down to the value the product provides the institutions. bringing on new accounts, cross selling, and encouraging a shift in habits (to online banking) is really what its all about.

the problem with most of these 3rd party PFM's, Wesabe, Geezeo, Thriv, etc. is that they add features but don't address this underlying need very well.

This doesnt mean that PFM is a bad idea. In fact, PFM is rapidly becoming a requirement, because of the all the hype around it. If a bank doesnt have it, there exists a risk that consumers will move to other institutions that do have it.

the build vs. buy question does come up, but outside of the top tier banks, few have the ability or desire to develop these tools in house. Reason: it would be hard to create a solution that kept pace with this evolving market. developing and maintaining these solutions in house would be costly and time consuming.

Another issue to consider is the outsourcing of these features. Consumers link to these features through online banking, but they are hosted off site! This is a regulatory and continuity issue for FI's. I believe Jwaala is the only company that has an inhouse deployed solution that resolves these concerns. Additionally, their product (first to market in 2006) is tightly integrated into the FI's core systems, making it seamless within the OLB application. Without that integration, the PFM solutions can only offer up its features based on the data fed to the application. This is limiting for the 3rd party / off site guys.

But non-the-less PFM is here to stay. These are great applications for consumers and will likely turn the tides on online channel. Give it 3-4 years and all banks will have these features. Of course, not all created equally!

Rob

-

[...] Wesabe, Gezeeo) that have announced that they will market their product to financial institutions (see the following blog entry). While they have very viable and competitive offerings they don’t have experience [...]

You know, I have to tell you, I really enjoy this blog and the insight from everyone who participates. I find it to be refreshing and very informative. I wish there were more blogs like it. Anyway, I felt it was about time I posted, I