マネーロンダリング対策関連のIT/ 業務支出: 2023年版

Celent estimates spending on AML technology and operations by financial institutions worldwide will reach US$58.0 billion in 2023, driven by new regulations and fines, increasing operational complexity, and financial institutions' imperative to reign in costs through process automation and AI/machine learning.

Abstract

In recent years, financial institutions have sought to lower AML compliance costs—and increase the effectiveness of their compliance programs—by modernizing AML technology with AI, process automation, cloud deployment, APIs and other next-gen techniques. Despite some firms attaining remarkable efficiencies in some areas from such enhancements, a steady onslaught of new regulation and increasing operational complexity conspire to keep AML costs rising.

Spending on AML Technology in 2023

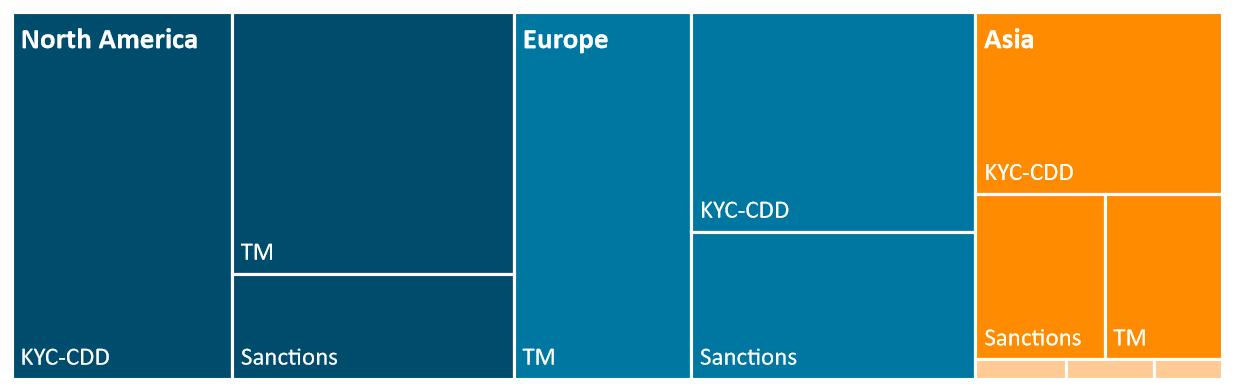

Source: Celent

This report, based on data from a proprietary Celent survey undertaken in 2022, provides our estimates of investments in AML technology—as well as operational spending on AML—by financial institutions worldwide, including banks, insurers, broker-dealers, and wealth and asset management firms. The report presents global estimates and breakdowns including:

- Spending by global region: North America, Europe, Asia, and the Rest of the World.

- Functional distribution of spending with focus on three key AML components: KYC-CDD, sanctions screening, and transaction monitoring.

- Technology spending breakdown by: internal spending, hardware, external software, and external services.

- Operational spending trends.

- Spending by type and size of financial institution.

- Spending on new initiatives vs. run-the-bank maintenance activities.

- Key technology trends and imperatives for financial institutions and solution providers in 2023.