North American Insurance Software Deal Trends, Life/Annuity/Heath Edition

Abstract

Insurance deal activity slowed by low growth projections in the segment.

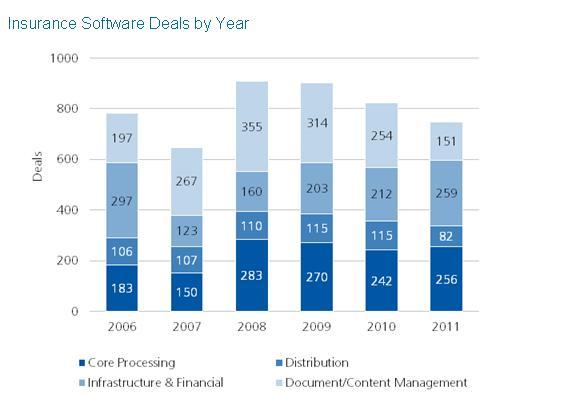

In a new report, North American Insurance Software Deal Trends 2012, Life/Annuity/Health Edition, Celent analyzes deal data provided by software vendors active in insurance in North America. A close look at 2010 and 2011 deals that fall into each metacategory and subcategory shows that, although 2011 showed signs of an improved economy, insurers continued their slow rate of investment in external insurance software.

The report breaks down deal activity by carrier size, type of deal, four broad metacategories (core processing, distribution, infrastructure and financial, and document/content management), and a number of subcategories. Data from previous Deal Trends reports are used to look at longer-term trends, and leading vendors for each metacategory are identified.

Based on vendor-provided data, the report also names leaders in the Celent Traction Index, which is an indicator of which companies are finding success in the insurance vertical.

“The general economic conditions of 2011 were clearly represented in the life and annuities deal data,” says Mike Fitzgerald, senior analyst with Celent’s Insurance group and coauthor of the report. “The year began optimistically, then volumes stalled and fell after the European uncertainties in the second quarter. If deal trends continue this pattern and mirror the overall economy in 2012, expect growth in the low single digits, barring any significant external shocks.”

“Our 2012 Deal Trends report shows that insurers have created long-term relationships with their software vendors. Again this year, we see insurers purchasing the majority of their software from vendors with whom they already have a relationship,” says Karen Monks, analyst with Celent’s Insurance group and coauthor of the report. “Our data shows vendors slowly expanding their relationships with their clients, proving that attentive account management and cross-selling efforts can be very effective.”