API-Based Corporate-to-Bank Connectivity: The Connective Tissue Enabling Real-Time Treasury and Payments

Abstract

Corporate-to-bank channel connectivity is a critical enabler for businesses of all sizes as they expand globally and increase the number of banks and accounts needed to conduct business. Historically, companies used a number of integration methods to exchange financial data: bank portals, mobile apps, host-to-host files, domestic networks, and the SWIFT network. However, over the past few years, APIs have emerged as a new connectivity channel for bank clients, enabling real-time, embedded, and automated data flows between corporates and their banks.

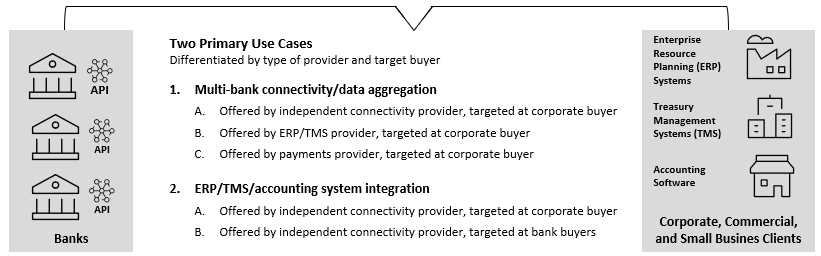

Celent identified two primary use cases for API-enabled connectivity: 1) multi-bank connectivity and data aggregation, and 2) ERP, TMS, and accounting software integration.

Next, we researched the solution provider marketplace, identifying and profiling 16 vendors across the globe, ranging from small startups to massive publicly traded corporations. Multiple providers support each use case, with some more focused on ERP or TMS integration, others enabling payment automation, and still others squarely dedicated to multi-bank connectivity.

Celent recommends different partnership models and solution providers depending on the bank and client segment. Looking across the corporate-to-bank connectivity landscape, one thing is clear. The time is now to formulate your API product and channel strategy. Celent’s deep expertise in the corporate digital channel segment can help you analyze the opportunity and build a compelling business case.

In this report, Celent profiles solutions from AccessPay, Cobase, Fides Treasury Services, FinLync, FISPAN, GTreasury, Isabel Group, Kyriba, Modern Treasury, Ninth Wave, SAP, SIX BBS AG, Starfish Digital, Treasury Intelligence Solutions (TIS), Trovata, and Volante Technologies.