Many retailers in Japan are small and medium-sized enterprises (SMEs). Growing sales is a top priority for businesses. At the same time, as small businesses, these enterprises and their owners have various financial and non-financial concerns. According to Celent's SME market research, there is a massive gap between the needs of SMEs and financial institution offerings. In addition, these enterprises are highly interested in digital platforms that could enhance overall commercial activity and eager for solutions to improve financing procurement and cash flow—both areas sorely lacking among bank menu offerings.

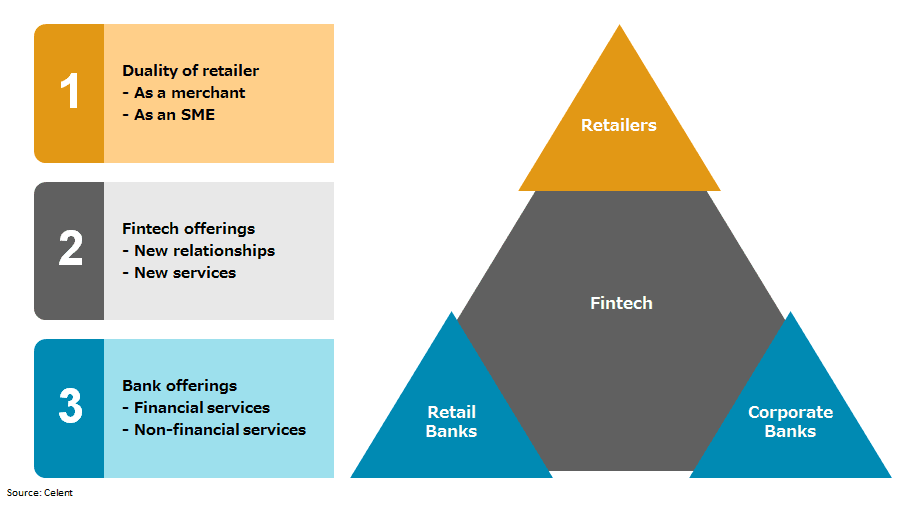

Retail Payment Triangle ― How big is the impact of emerging technologies on creative disruption?

This series of reports is based on Celent's payment taxonomy and adopts four perspectives to examine Japan’s payment infrastructure: A) payment instruments and channels, B) corporate payments (wholesale payment services, large-value services), and C) retail payments (retail payment services (including retailers) and small-value payments services), and D) the current state of the financial market infrastructure (FMI). Part 1 of this series examined the Zengin System (the national bank data communication network system). Part 2 undertook an examination of the Bank of Japan Financial Network System (BOJ Net).

Part 3 of the series focuses on corporate payments, namely large-value payments and wholesale payments, and examines advances in payment infrastructure, promising new technologies and emerging service providers, and the inherent new value and related risk. In addition, this report addresses global trends essential to the discussion of advances in payment services and the creation of disruptive payment services, the current state of the Japanese market, and coming initiatives. Part 4 of the series will examine the diversification of payment instruments and channels, especially trends in small-value and retail payment services, coupled with an analysis of new operators and technology usage.