昨年に引き続き、北米のバイサイド企業は利益率への下押し圧力に取り組んでおり、オペレーティングコストの削減がIT支出の重要な戦略的ドライバーとして挙げられている。世界のバイサイド企業と比較すると、北米のバイサイド企業も、競争が激化する米国やカナダの投資市場でユニークな投資提案を発見するために、金融商品や助言サービスの強化に予算を配分している。商品への投資の観点から最も重要な優先事項は、デジタルによって強化された資金配分のためのツールやチャネル、データおよびポートフォリオアナリティクスのカテゴリーに分類され、これらは「必須」の投資項目と考えられている。

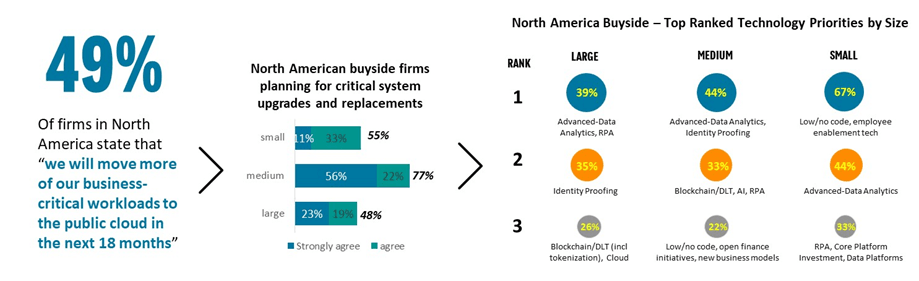

北米の投資会社全体では、クラウドを活用してアップグレードと最新化を図るという進化が起きている。この動きは、特に中規模の投資会社の間で広がっており、中規模会社の77%以上が重要なシステムのアップグレードや入れ替えのほか、よりビジネスクリティカルなワークロードのクラウドへの移行を予定しており、その割合は、北米の大規模および小規模の投資会社よりも顕著に高かった。

多くの中規模企業では、M&Aにより断片化された古いレガシーアプリケーションのために、依然としてテクノロジーインフラを統合する必要がある。さらに、広範で合理化されていないファンド商品のフットプリントの結果、戦略やサブスケールファンドにかなりの重複がある。さらに、不明瞭で最適とは言えない「AI対応」ITソーシングやデータ活用アプローチにより、中規模運用会社のマネジャーは、自社のコアコンピタンスを差別化できる分野への取り組みを再検討し、その分野に再度注力する必要がある。規模だけで、自動的に拡張性、効率性、成功につながるわけではではない。焦点を絞り、専門性を高め、データとテクノロジーを巧みに連携させることも、考慮すべき重要な要素である。マクロ経済の不確実性が広がり逆風が強まる中、投資会社は、ビジネスユースケースの適切な組み合わせを慎重に選択してこれに焦点を当て、新たなAI機能、解析機能、データイネーブルメント機能を統合することが重要である。

セレントの調査では、アセットマネジャー、ヘッジファンド、年金ファンド、ミューチュアルファンド、ソブリンファンドのマネジャーから収集したデータを基に、北米のバイサイド企業が重視しているテクノロジー、商品投資、戦略的優先事項にスポットを当てている。厳しい経済情勢の下でも、バイサイド企業は引き続き積極的に投資を行い、様々な革新的な商品の取り組みをサポートしていく必要がある。

本レポートと同じシリーズのセレントレポートは以下の通り。

Capital Markets / European Buy Side IT Priorities and Strategy 2023

Capital Markets / Global Buy Side IT Priorities and Strategy 2023

----------

バイサイド、セルサイド、マーケットインフラのトレンドやテクノロジーに関する詳しいリサーチについては、Capital Markets practiceをご覧ください。

また、セレントレポートの定期購読者は、以下関連レポートもご覧いただけます。

- Alternatives and private markets: Mega trends, IPOs and the next wave

- Technology Trends Previsory: Buy Side 2024 Edition

- ESG Delivery Under Scrutiny: "Walking the Talk" to Resolve the Credibility Gap

- Operational Alpha on the Buyside: Crystal balling future hybrid provider propositions and ecosystem innovations

- NextGen Invest and Risk Tech: Gazing Through A Crystal Ball Into 2030

- End-to-end solutions set to revolutionize investment technology