European buyside firms are going into 2024 under a thicker blanket of geopolitical and economic uncertainty.Even amid weaker performance and margin pressures in recent years, client expectations and efficiency ambitions continue to rise. Two overarching strategic business drivers for technology investments are apparent in our survey for next year and beyond: Enhancing operational speed/agility anddriving product/proposition innovation. Like peers around the world, many European firms are focusing their investment budgets on sharpening product and advisory offerings to discover unique investment propositions in an increasingly crowded market. European firms continue to actively pursue digitalization strategies to enhance strategic product propositions and differentiated investment engine activities. These themes interconnect and align with other objectives such as regulatory compliance, customer experience, and systems modernization efforts.

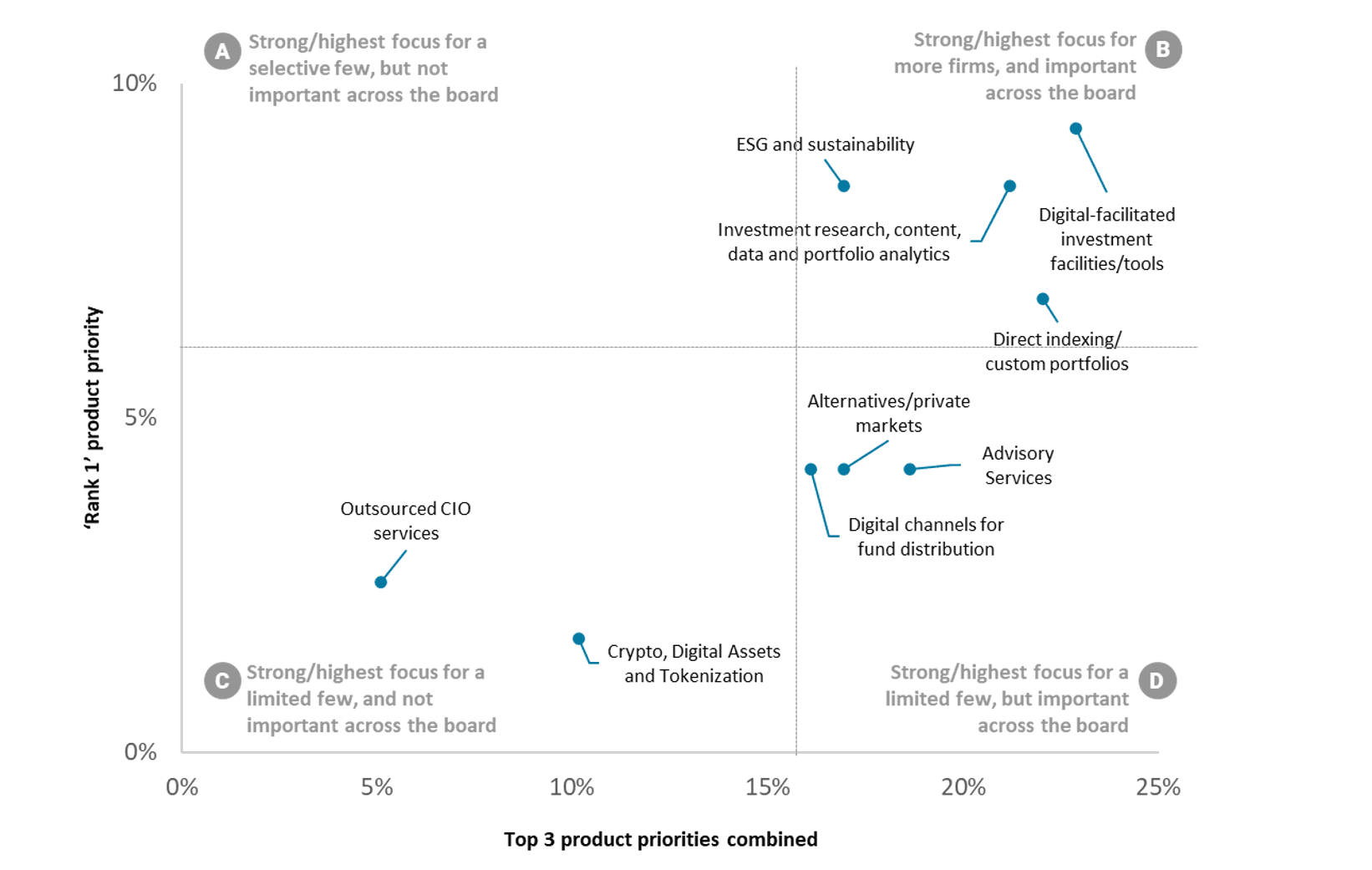

From a product investment perspective, the most significant priorities fall into several categories – digital-augmented tools and analytics, portfolio customization, ESG product propositions, and rich content (research, data, and analytics) are 'must haves' for many firms and hold a high degree of importance across the board across the European regions we analyzed.

In line with product/proposition innovation ambitions, investment firms that are at the forefront are elevating their product management functions to serve as a “strategic bridge” between distribution and portfolio management. By utilizing digital technology and sophisticated data science approaches, leading firms are pursuing ambitions to attract flows and drive growth by positioning front office teams to combine insights about client demands from the field, with deep portfolio management capabilities.

The journey to evolve workloads into the cloud is another noticeable trend, albeit nuanced across the regions we analyzed, with organizations having their own interpretations of which workloads are suitable for migration based on risk tolerance and regulatory requirements.

Our research highlights exactly which technologies, product investments and strategic priorities lead European buyside agendas, based on data from asset managers, hedge funds, pension funds, mutual funds, and sovereign funds. The report's insights compare and provide a nuanced view across different firm tiers and three regions: the UK and Northern Ireland, Western Europe and the Nordics, and Southern and Eastern European countries. Despite market fluctuations, buy side firms still need to support a range of modernization and product enhancement initiatives, and firms should ensure that their own technology plans are inline.

This research is a companion study to Celent’s Global Buy Side IT Priorities and Strategy 2023.

----------

For more in-depth research around buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.

Celent clients can also access relevant studies:

- Global Buy Side IT Priorities and Strategy 2023

- Technology Trends Previsory: Buy Side 2023 Edition

- ESG Delivery Under Scrutiny: "Walking the Talk" to Resolve the Credibility Gap

- Operational Alpha on the Buyside: Crystal balling future hybrid provider propositions and ecosystem innovations

- NextGen Invest and Risk Tech: Gazing Through A Crystal Ball Into 2030

- End-to-end solutions set to revolutionize investment technology