In a previous installment of this research series, "Operational Alpha on the Buyside: Riding New Waves from Front-to-Back Technology, Data, ESG and Outsourcing", we examined where and how investment managers are forging new tactics in their quest to improve operating economics and efficiencies. This second installment highlights our views on emerging vendor and solution value propositions that increasingly deliver investment and operational coverage on an end-to-end basis.

Strategic factors are reshaping the solution marketplace and creating opportunities

Throughout the investment value chain, rapid advances and adoption of cloud-based infrastructure components, advanced analytics, open source paradigms, and the modularization of technology building blocks and applications have already opened up new possibilities for innovative propositions (which will continue) while reducing time-to-market for deploying new capabilities through digital IT delivery approaches such as design thinking and agile development/execution methods.

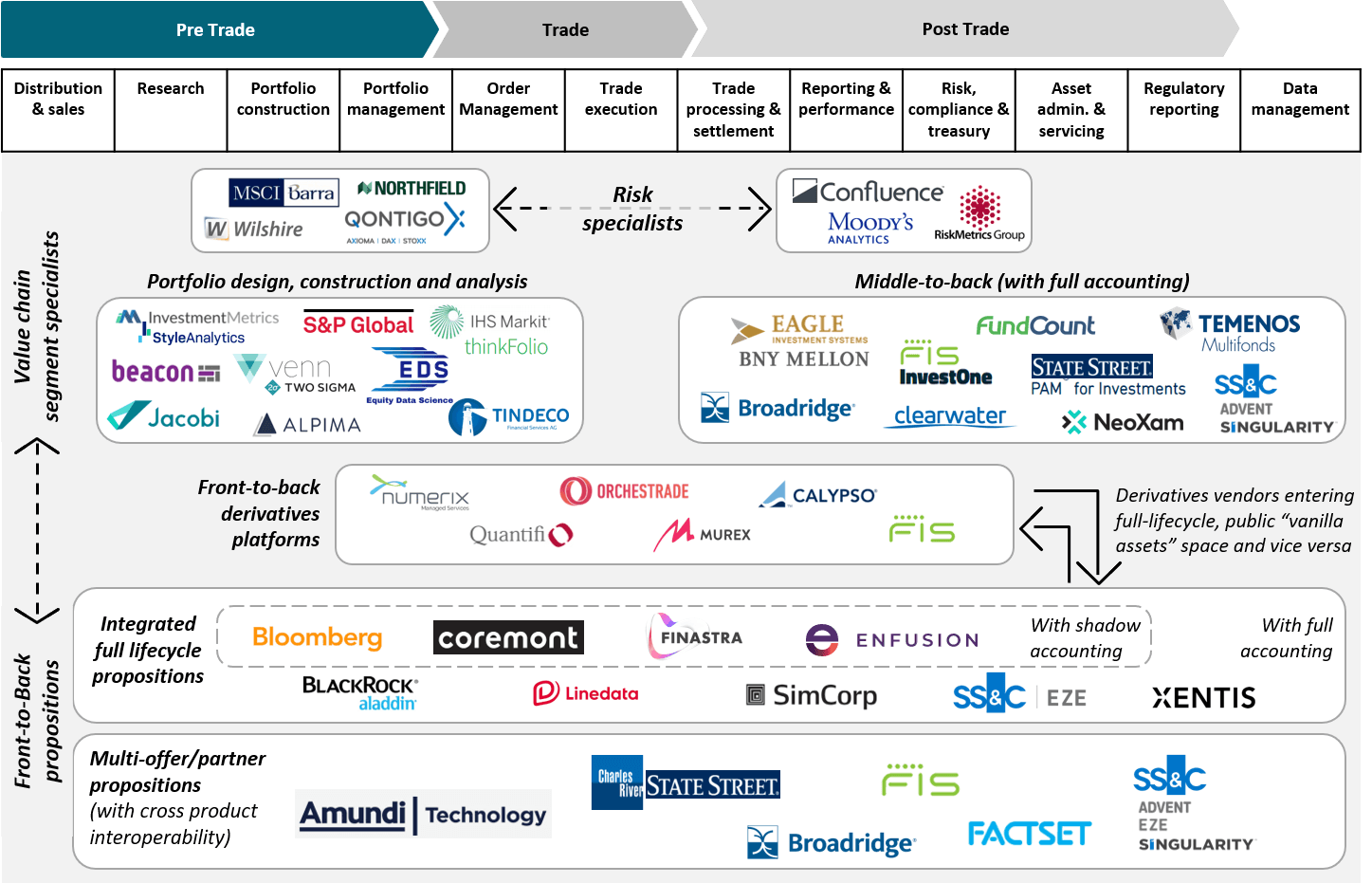

The evolution of the vendor and solution provider market is playing out across various levels. As investment managers and asset owners improve the management across investable asset classes, they are also exploring technologies to converge fundamental and quantitative investment paradigms, and front and middle office processes. These are precipitating the redrawing and redefining of vendor battle lines across the investment technology value chain.

To date, examples of innovations have been relatively sporadic but growing, characterized by the following dynamics:

- We see momentum and adoption continue to expand across various parts of an asset manager’s core investment engine, changing a firm’s bases of competitive advantage and alpha generation capabilities – certain use cases being applied in an investment context are potentially disruptive whilst others can be complimentary to existing buyside ecosystems (such as through custodians, administrators, front to back platforms).

- There is continued end-client demand for hybrid approaches that combine software, managed services and outsourcing – evolving from front-to-back software solutions towards what we terms as "full lifecycle propositions", enhanced and enabled by next generation cloud technologies.

- This may come in the form of a vertically integrated provider that can span all hybrid approaches but can also manifest itself in the form of strategic multi-product/ partner propositions that can collectively form cohesive end-to-end offering for investment management clients.

Investment managers, technology vendors and solution providers must brace themselves and make strategic decisions about where they want to play, and how they want to collaborate in the new world that is emerging.

To learn more about how investment management firms are upgrading their operations and technologies, please contact Celent for more information on our latest reports on these topics (subscribers can link through to the full reports):

- Operational Alpha on the Buyside: Riding New Waves from Front-to-Back Technology, Data, ESG and Outsourcing

- Operational Alpha on the Buyside: Strategic Levers to Exploit “Ecosystem in a Box” Paradigms

- End-to-end solutions set to revolutionize investment technology

- NextGen Invest and Risk Tech: Gazing Through A Crystal Ball Into 2030

- Embracing NextGen Invest and Risk Tech (Asset Manager Edition)